SEATTLE WEALTH MARKET BUZZES WITH GROWTH

Seattle Wealth Market Buzzes with GrowthBy Tom StabileApril 11, 2013The primary market of the Pacific Northwest is chugging along with wealth management market activity ‚Äì hires, newoffices, acquisitions of advisory firms, and new attention for its concentration of high-net-worth investors. And part ofthe reason is that the Seattle market isn’t just home toMicrosoft and its ilk, but far more diverse.”People think of Seattle as being a technology town,” says Nancy Reid, who is launching a new chapter in the cityfor Tiger 21, a peer learning group for ultra-wealthy investors. “That’s only part of the story.”Seattle would be just the 12th city where TIGER 21 has chapters, in part because it doesn’t have “a single dominantindustry,” with multiple anchors in aerospace, telecommunications, biotechnology, and natural resources, Reid says.It doesn’t hurt that the Emerald City’s market hosts corporations such as Boeing, Starbucks, Amazon, Costco, andExpedia, as well as an active “venture capital ecosystem” and plenty of entrepreneurs.”We’re pretty sure we’re not the only ones who have noticed,” she says. “Anyone who has interest in supportingentrepreneurs and wealth creators can see what’s happening in Seattle.”Various wealth management firms have also been stepping up their presence in the Puget Sound region throughhires or acquisitions, including J.P. Morgan, U.S. Bank, Focus Financial Partners, and United Capital FinancialPartners.”You get the sense there is more [hiring] activity,” says Kristen Powers Bauer, senior relationship manager in Seattlefor the western region at Threshold Group, a multi-family office firm built around the wealth of the clan that foundedRussell Investments. Threshold itself expanded to Seattle two years ago from its headquarters about an hour southin Gig Harbor, Wash. “We have five people here now, and we’re making plans to add more.”The city is essentially the “biggest mid-cap market in the U.S.,” because of its cluster of successful smaller companies,and that also holds true in the advisory market, says Darren Casey, managing partner of Montlake Group, a Seattlerecruiting firm.”It’s interesting that most [of the advisory firms] have been pretty successful,” he adds. “And whether it’s Costcomoney or Microsoft money or Amazon money, there’s enough here for even the smaller [advisors] to have a strongpresence.”The market has been one of the fastest-growing in the country for ultra-wealthy investors, according to a report fromLondon-based WealthInsight, which defines that group as those with at least $30 million in assets. While it’s only the23rd-largest market for such individuals in the U.S., with almost 200 of them in 2011, it was tied for fifth in growth ofthat segment, rising 27% between 2007 and 2011, alongside Wichita, Kan. The only cities growing their ultra-richpopulations faster were Houston, San Antonio, Oklahoma City, and Greenwich, Conn.The wealth management market is also in bloom from a hiring perspective, Casey says. “Clearly, there is more activitytoday than there was two years ago,” he says. “It hasn’t gone exponentially crazy, but we see existing companiesexpanding ‚Äì sometimes to go upstream for bigger clients, some going downstream ‚Äì and a few new players.”

About TIGER 21

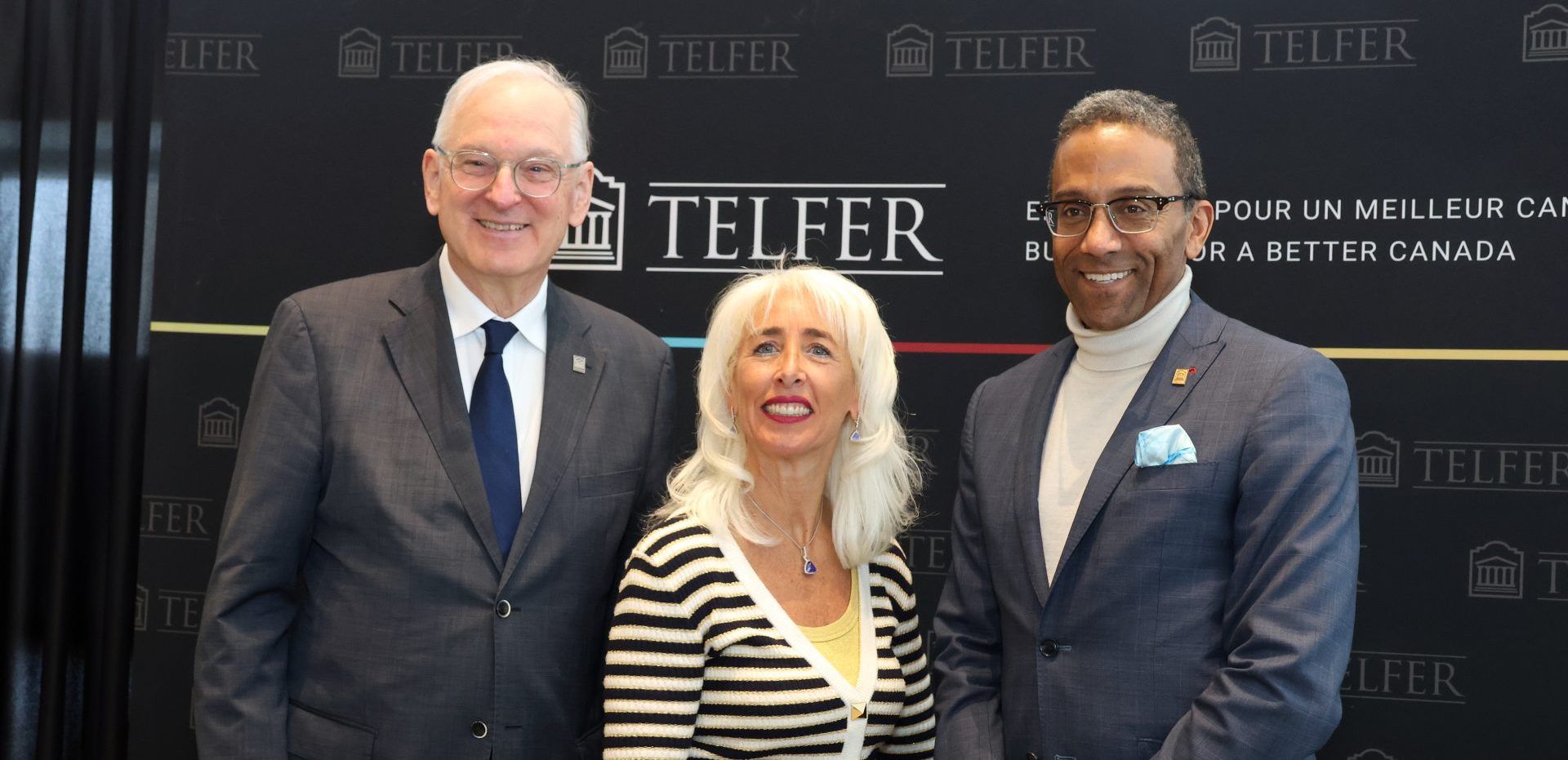

TIGER 21 is an exclusive global community of ultra-high-net-worth entrepreneurs, investors, and executives.

Explore the TIGER 21 Member Experience