TURNING CONSERVATIVE INVESTING UPSIDE DOWN

Has conservative investing been turned upside down?

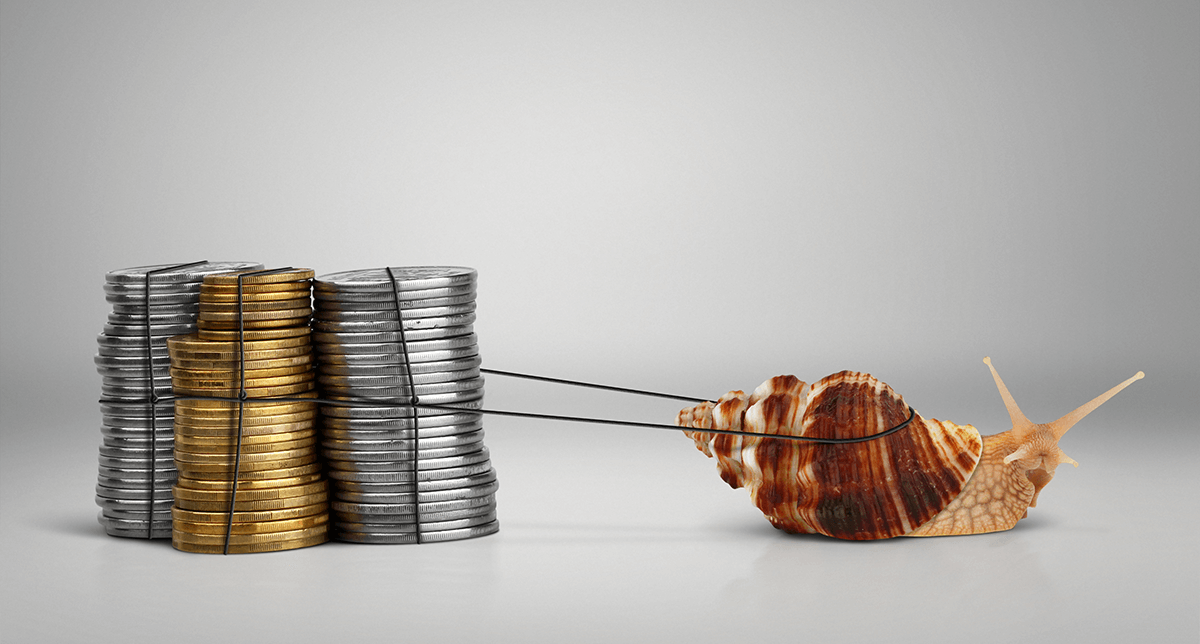

Normally, investors would be looking for safe havens at a time like this, for a number of reasons: dizzying valuations, disruptive technologies, geopolitical instability, and an uncertain tax and policy outlook. However, with cash yields running below the prevailing rate of inflation and bonds especially vulnerable to a rise in interest rates, moving money to the sidelines does not seem especially safe these days.

That’s why it seems conservative investing has been turned upside down, with traditionally safe havens carrying an unusual element of risk. Fortunately, the other side of the coin is that for well-funded and patient investors, some degree of safety can be found in unexpected places. This is especially true for those who are willing to look past conventional definitions of risk. The aggregate asset allocation of TIGER 21 members suggests that they may be doing precisely that.

Understanding why there might be some measure of safety in what would traditionally be thought of as riskier investments starts with recognizing the limitations of conventional measures of risk such as beta. Beta is a measure of short-term price volatility, but wealthy investors are not generally trying to stake their fortunes on short-term fluctuations. People who are trying to nurture wealth for the long-term should look at risk differently. Here are some examples:

-

Do not assume liquidity and safety are the same things

This often trips up professional investment advisors. They tend to view private investments as further out on the risk spectrum than public ones because of their illiquidity. The truth is, what is the benefit of immediate liquidity to investors who are in it for the long term? TIGER 21 members have more money in direct investments (primarily private equity and real estate) than in publicly-traded stocks and bonds. As long as their immediately foreseeable needs are taken care of through a combination of liquid reserves and positive cash flow, committing to the longer holding periods associated with direct investments does not necessarily increase risk. On the contrary, to the extent these investments help avoid precarious public market valuations and unnaturally-low bond yields, direct investing can be a way to reduce rather than increase risk. This is simply a matter of responding to conditions. It is easy to envision an environment where a stock market correction and/or a spike in bond yields attracts a much larger share of TIGER 21 member investments to public markets, because money can be put to work more quickly in those markets than in private ones. For now though, there is nothing appealing about the value proposition offered by public markets.

-

Income generation may be more important than price performance

This is another distinction between short-term and long-term investors. Price fluctuations are of primary importance to short-term investors, while for long-term investors the value of an asset is derived largely from its ability to produce income over time. In part, this may help explain the preference TIGER 21 members have for real estate. At 31 percent, this is the largest average allocation of our members, but that need not be interpreted as a bullish call on the real estate market overall. To some extent, it is likely a reflection of the fact that real estate is a relatively appealing source of income in a low-yield environment. Focusing on income generation rather than price fluctuations can be a revealing way to look at the risk of an investment. When the stock market dropped by nearly 48 percent between September of 2007 and March of 2009, it was devastating to short-term investors. To long-term investors more interested in income generation than price fluctuations, the pain was much milder, as S&P 500 dividends declined by less than 14 percent.

-

International investments need to be viewed in the proper diversification context

Taken on their own, non-US investments are generally riskier than US investments. However, to the extent that their performance is somewhat non-covariant with that of US investments, they can represent a complement to US investments that reduces risk statistically. More fundamentally, introducing an allocation of international investments into a portfolio can be an effective risk-reduction move simply because they are exposed to a differing set of economic risks than domestic investments. For people like TIGER 21 members in particular, who may have substantial business holdings concentrated primarily in domestic markets, an international element of their investment portfolios may represent a dampening rather than a heightening of overall risk.

-

Barbells may make more sense than balance

The average TIGER 21 portfolio is fairly heavily invested in real estate and private equity (52 percent combined). It is also pretty heavily invested in cash equivalents, at 11 percent currently. In contrast, the average TIGER 21 portfolio is relatively light is in asset classes that usually represent the meat-and-potatoes of investor allocations. Public equity and bonds represent only a combined 31 percent currently. With a majority allocated to direct investments at one extreme and a fairly high cash position at the other, the average TIGER 21 portfolio can be described as barbelled rather than balanced. This may reflect a rational assessment of the current climate. By reducing exposure to the muddled middle of stocks and bonds, members may feel they can both put money to work more productively in direct investments and keep a reserve in store to capture future opportunities.

If the above approaches to risk management are more conceptual than quantitative, it is for good reason. Risk cannot always be quantified. Measures like beta don’t reflect the sensitivities of most real-world investors, and the relevance of backward-looking statistics is diminished in an environment that lacks much precedent. Active business judgement rather than quantitative methods may be the best response in such an environment. Being willing to apply non-traditional risk management concepts does not guarantee success in navigating a perilous investment environment. However, pursuing strategies such as maintaining a low exposure to public equity and bond markets in response to a high valuation/low yield environment at least gives TIGER 21 members the chance to apply their business savvy to this challenging environment rather than passively accepting risk.

About TIGER 21

TIGER 21 is an exclusive global community of ultra-high-net-worth entrepreneurs, investors, and executives.

Explore the TIGER 21 Member ExperienceMember Insight Reports