ASSET ALLOCATION REPORT 2021: 1ST QUARTER

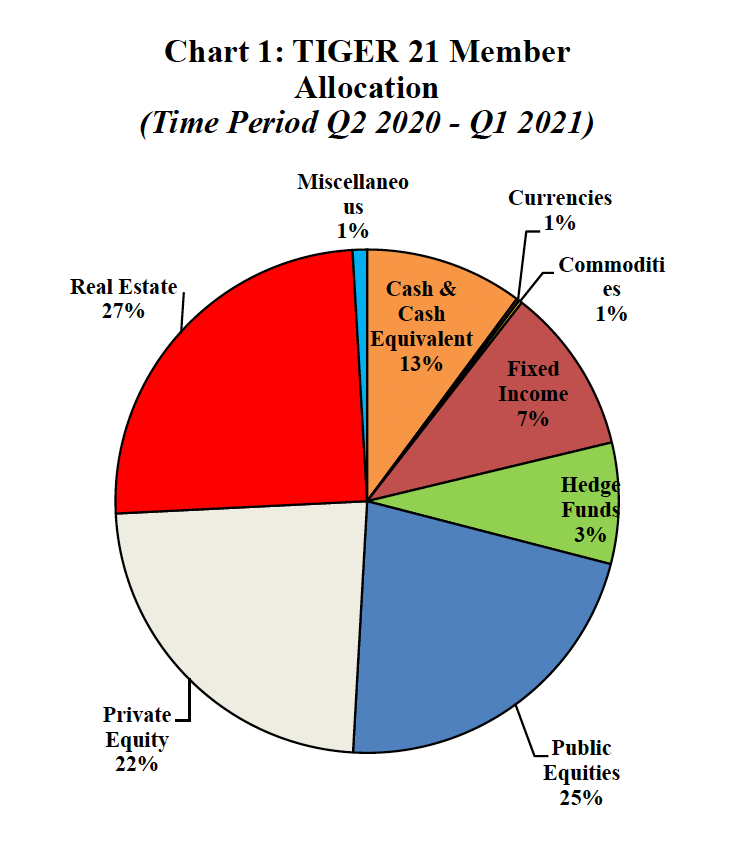

Public and Private Equity continue to jockey for the second largest allocation behind reigning king, Real Estate, holding fast at 27%. Public Equity edged out Private Equity at 25% vs 22%, marking the first time in three years that Public Equity is preferred over Private Equity.

The TIGER 21 Asset Allocation Report showed an increase in Members’ allocations to Public Equities and Currencies with declines in Private Equity. Allocations to Real Estate, Cash, Commodities, Fixed Income, and Hedge Funds did not change from 4th quarter 2020 levels.

The jump in Public Equity is the largest allocation this asset class has seen since the second quarter of 2009. Private Equity remained a top investment, but dipped significantly to 22% — a four percentage point decline – as Members returned to the public markets.

Members showed more interest in currencies over the first quarter of 2021, with an allocation of 1%. Most of this allocation was in reference to crypto investments – an area where Members are seeing growing opportunity.

Cash remained at 13%. According to TIGER 21’s Flash Poll last summer, which supplemented our quarterly Asset Allocation Report during those unprecedented times, Cash peaked at 19% from a historic range of 11 – 13%, but Members have eased back into investments in areas where they have traditionally allocated their assets. In that context, Cash remains at the high end of the historic band recorded prior to COVID.

Methodology

The TIGER 21 Asset Allocation Report measures the aggregate asset allocations (on a trailing 12-month basis) of TIGER 21 Members based upon their individual annual Portfolio Defense presentations. Each individual Member generally reports on their portfolio annually, so that in any given month of the year approximately 1/12th of our membership reports. Each quarterly data set represents data for the prior 12 months (from quarter’s end). This methodology tends to reveal substantive trends more clearly and is less affected by short-term distortions stemming from our growing membership.

Disclaimers

Liability & Accuracy

These materials should not be interpreted as a recommendation or opinion by TIGER 21 that you should make any purchase or sale or participate in any transaction. TIGER 21 does not guarantee the accuracy of or endorse the views or opinions given by the authors of these materials. TIGER 21 will not be liable for any errors or inaccuracies in such materials, or for any actions taken in reliance thereon. TIGER 21 is not a registered investment adviser or broker-dealer and does not provide investment advice or recommendations to buy or sell securities, to hire any investment adviser or to pursue any investment or trading strategy.

Sharing & Distribution

The TIGER 21 Asset Allocation Report is not permitted to be published in its entirety and/or otherwise publicly distributed outside of the TIGER 21 website unless authorized by TIGER 21 PR & Media Relations. Please contact pr@tiger21.com with any questions.

About TIGER 21

TIGER 21 is an exclusive global community of ultra-high-net-worth entrepreneurs, investors, and executives.

Explore the TIGER 21 Member ExperienceMember Insight Reports