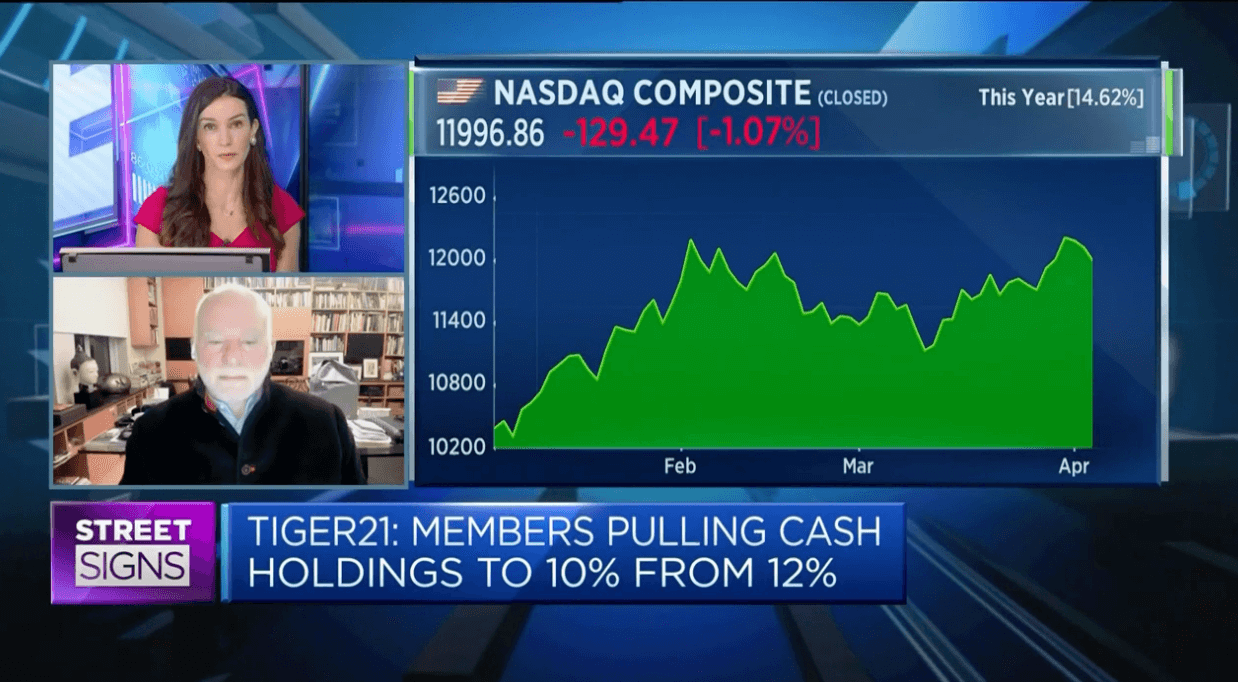

TIGER 21 Founder Featured on CNBC to Talk About Changes in Asset Allocations

Share on Social

Founder and Chairman of TIGER 21, Michael Sonnenfeldt, was recently featured on CNBC’s Street Signs Europe to discuss how the group’s Members have changed their asset allocation in recent quarters. Here are a few highlights:

- Private equity has become the membership network’s largest allocation at 31%, surpassing real estate for Q4 2022. Despite the pullback in allocations, 70% of Members are still looking for new opportunities in real estate for the next year.

- Historically, Members held around 12% cash, but more recently, have pulled back to 10%, signaling that they are still comfortable with long-term investments that hold value yet continue to hold cash to weather any storm.

- From a long-term perspective, technology remains a top category of interest, as 40% of Members are looking for opportunities to invest in tech in the coming year.

Watch the full video here.

About TIGER 21

TIGER 21 is an exclusive global community of ultra-high-net-worth entrepreneurs, investors, and executives.

Explore the TIGER 21 Member ExperienceMember Insight Reports