Omaha Calling: 2023 Berkshire Hathaway Meeting

Thanks to TIGER 21 Member Steven Check, over 50 TIGER 21 Members and their guests attended our inaugural Berkshire Hathaway event in Omaha. Among the group were several first-time attendees to Berkshire Hathaway’s Annual Meeting, along with veterans who have been making the annual journey to Omaha for years.

Members kicked the weekend off with a Friday night dinner at steakhouse Mahogany Prime. They mixed and mingled before sitting down to a meal paired with wines from Napa’s Smith-Madrone and Canard wineries. Geographic representation was diverse, and included Members and Chairs hailing from Austin, Dallas/Ft. Worth, Boston, Denver, New York, Connecticut, Chicago, Washington D.C., Las Vegas, Los Angeles, and San Francisco. Some brought family members along with them.

The attendees brought high energy and had stimulating conversations about diverse topics such as tricky succession issues in family businesses, what to do with your life after an exit, and even must-listen to podcasts. Members appreciated the chance to share their experiences and advice with each other. They forged personal bonds – at dinner, while standing in line before dawn to get the best seats in the CHI arena – or arranging to meet via online posts on the TIGER 21 Events app.

Of course, everyone was there to hear “The Oracle of Omaha” give his take on investing and markets. We weren’t disappointed. Below are highlights from the discussion.

Omaha Stakes

Banking sector. Berkshire Hathaway has held large stakes in banks over the years. However, both Warren Buffett and Charlie Munger are circumspect on the sector now, in part because of what they see as a lack of attractive acquisition targets.

Apple holding. Buffett noted that Apple, Berkshire’s largest individual stock holding, at 5.6%, is “a better business than anything we own … and a position we’re very happy to have.”

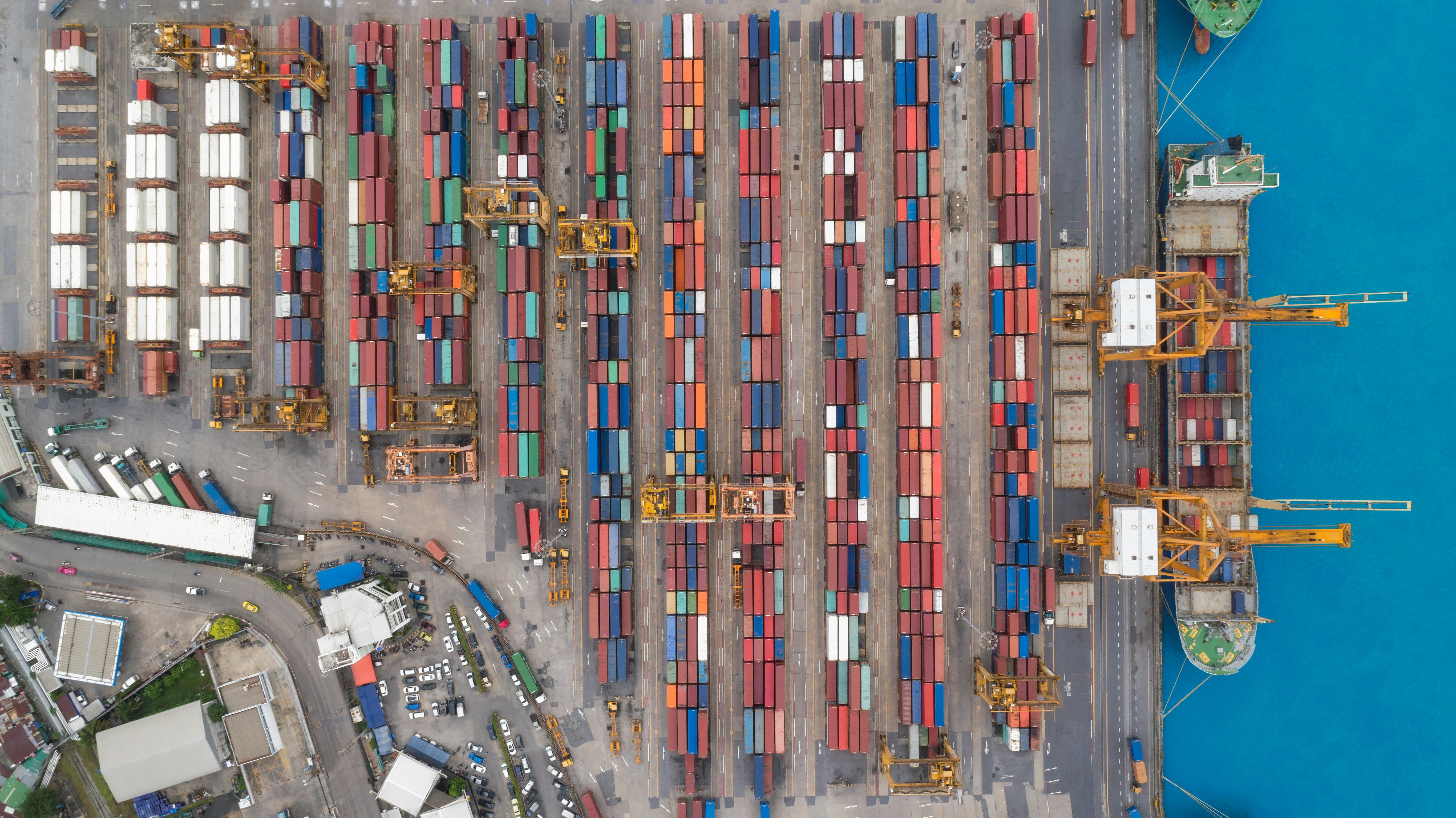

Japanese corporates. Asked about their $10 billion investment in five Japanese trading companies, which Munger had discussed in interviews prior to the Annual Meeting, Buffett described himself and Munger as “pleasantly surprised” during their recent visit, going on to say that they “love the way they’re operating.” Berkshire’s ability to benefit from low financing costs (.5%) in yen removed currency risk. At the same time, Berkshire is earning a 14% return on these investments. Their plan is to hold the stakes, roughly 7.6% in each of the companies, for the long-term.

Estate planning. TIGER 21 Member Marvin Blum had an opportunity to pose a live question during the meeting. (Attendees who want to ask Warren Buffett and Charlie Munger questions are chosen by lottery.) Blum’s question concerned the challenges of managing succession and estate-planning for family-owned businesses, comparing parents who fail to prepare their children to run the business to quarterbacks who don’t prepare their teammates to receive the football pass. It’s a topic that’s certainly top of mind for many of our Members, and about which there had been active discussion over dinner the night before.

Buffett acknowledged that there are “a thousand variables,” at play, and the particulars need to reflect individual family dynamics. He singled out communication and behaviors as critical in advising, “Don’t think a will substitutes for modeling your values.” He also emphasized the importance of transparency, saying “in my family, I don’t sign a will until my children have read it, understood it, and made suggestions.” He was equally clear on his firm belief that not getting it right is “one mistake you don’t get to correct.”

Technological development. In discussing the risks he sees and the skepticism he feels around the promise of artificial intelligence (AI), Buffett referenced both the creation of nuclear weapons, which were created “for very good reasons,” and an Einstein quote: “it can change everything in the world except how men think.”

Risk management. Throughout the day, Buffett’s responses highlighted key elements of Berkshire’s philosophy, including a bedrock guiding principle – stay in control of your destiny. In practice, this means not playing Wall Street’s game of prioritizing short-term quarterly performance; not making emotional investment decisions; not loading up on debt; and above all, not paying an annual dividend. As Buffett explained, “the reason we got where we are is because we kept the money.”

Buffett and Munger were in fine form, displaying their trademark wit, intelligence, humility, and humor throughout the day. They shared reminiscences from 58 years(!) of partnership as they answered questions on everything from their confidence in Berkshire’s insurance businesses to banking sector vulnerabilities. Buffett in particular was very bullish on the U. S. investment landscape, stating a few times that he’d love to be starting out in investing today.

About the Author

Deborah Adeyanju, CFA, CFP ® is the Investment Networks Manager at TIGER 21. As the key ambassador for the Investment Networks on TIGER 21’s exclusive Member App – T21 Connect, Deborah helps shape Members’ online experience. She is responsible for engaging and activating Members and encouraging conversations and connections throughout the wider TIGER 21 community.

Learn more about the TIGER 21 Member experience here.

About TIGER 21

TIGER 21 is an exclusive global community of ultra-high-net-worth entrepreneurs, investors, and executives.

Explore the TIGER 21 Member ExperienceMember Insight Reports