Outlook for Markets in 2023 | TIGER 21 Founder on CNBC’s “Worldwide Exchange”

With the recent surge in rates and fears of an economic slowdown, 60% of TIGER 21 Members believe we are going into a recession while the network’s private equity allocation is at an all-time high. For years real estate was king, but it is now trailing private equity and public equity in TIGER 21 Members’ Asset Allocation, said TIGER 21 Founder and Chairman Michael Sonnenfeldt in an interview from TIGER 21’s Global Exchange with CNBC’s Brian Sullivan.

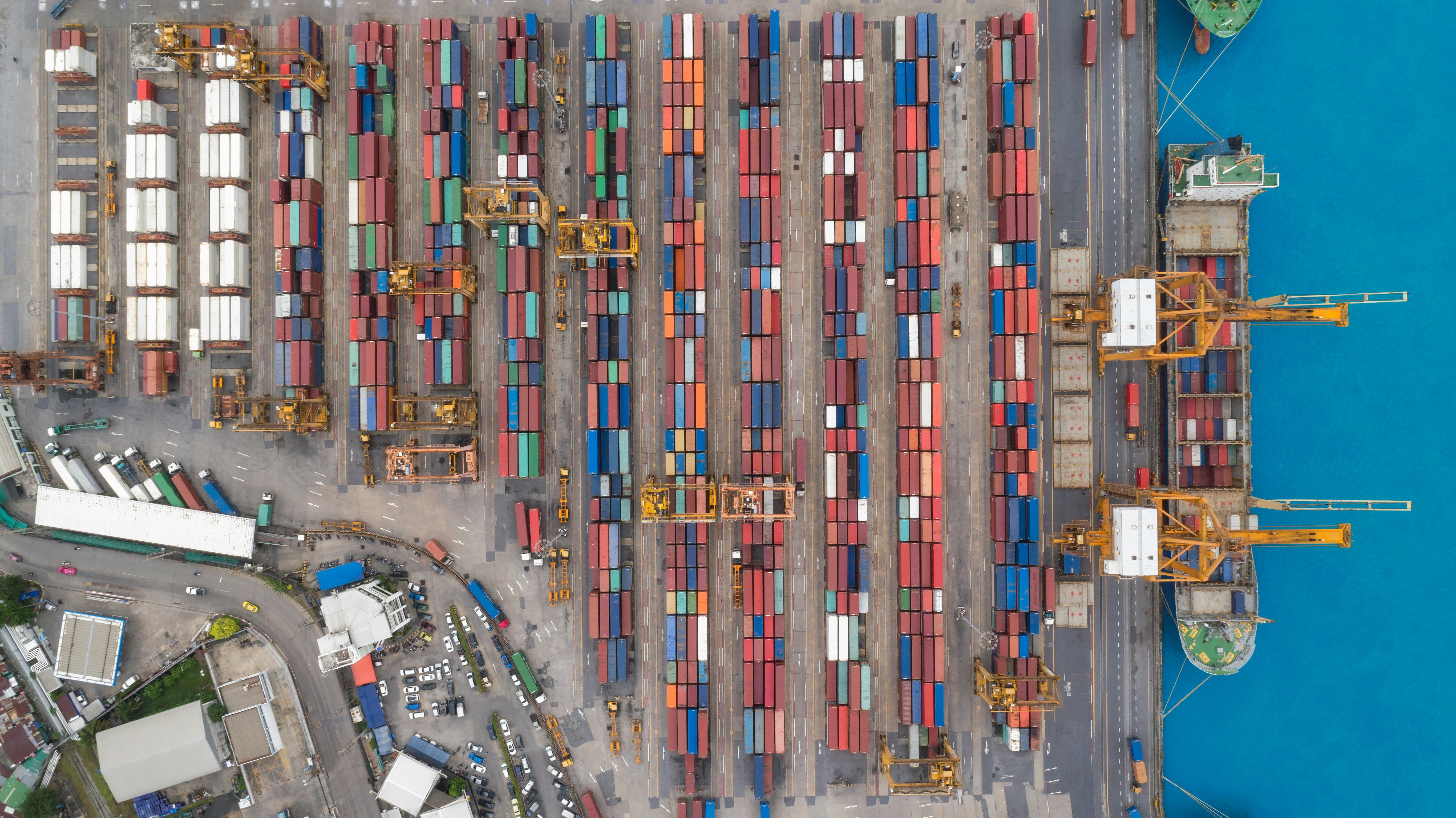

Many Members believe interest rates are not going to go up as quickly as they have in the past. They may have already hit their peak six or eight months ago causing reduced demand and supply chain issues, which are now on a downward trend.

About TIGER 21

TIGER 21 is an exclusive global community of ultra-high-net-worth entrepreneurs, investors, and executives.

Explore the TIGER 21 Member ExperienceMember Insight Reports