Member & Chair Insights

July 30, 2025

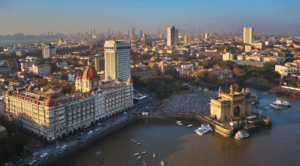

[Check Back Soon for Recording] Challenges & Opportunities: Why Asia’s UHNI Entrepreneurs & Investors Aren’t Facing Them Alone

Reaching a certain level of success comes with opportunities and challenges—ones that ultra-wealthy individuals can’t discuss with just anyone. When seeking candid, objective conversations on topics such as investing, family dynamics, succession, and legacy, many UHNI in India and Singapore are turning to confidential peer groups. Before committing to membership in a peer group, ultra-high-net-worth investors and entrepreneurs need to weigh several key considerations to ensure alignment between their goals and the benefits each peer group provides. Join us for a conversation discussing these co...