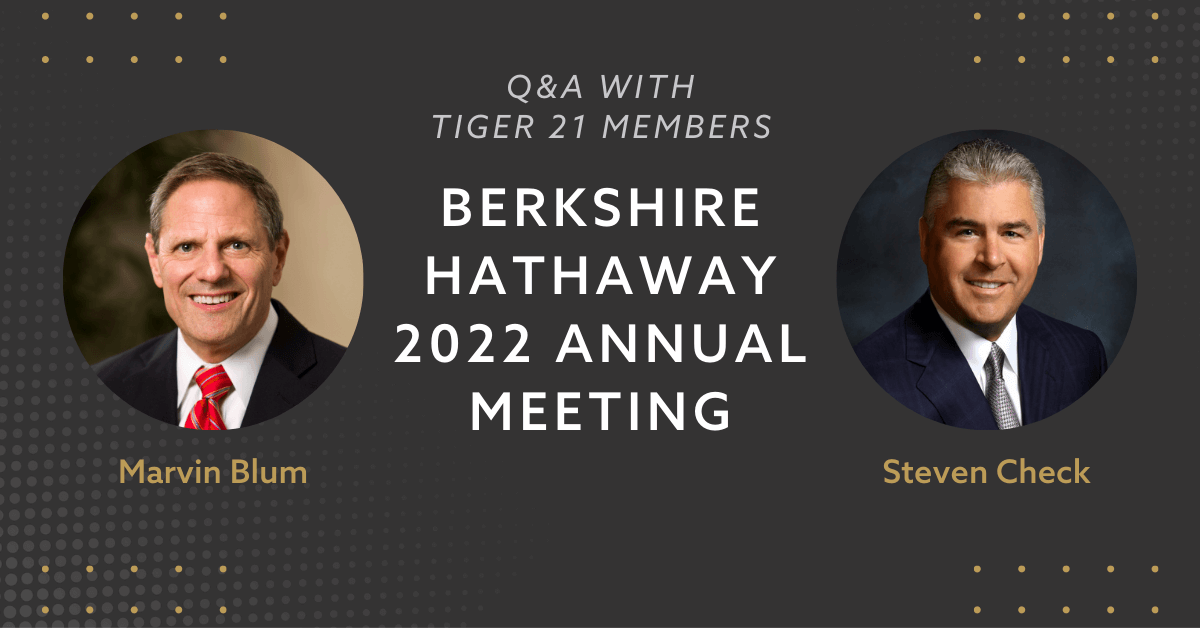

2022 Berkshire Hathaway Annual Shareholders Meeting: Top Takeaways & Perspectives from TIGER 21 Members

2022 Berkshire Hathaway Annual Shareholders Meeting:

Top Takeaways & Perspectives from TIGER 21 Members

Marvin Blum

Founder and Managing Partner of The Blum Firm, P.C., and TIGER 21 Member

Steven Check

Founder of Check Capital, Inc., and TIGER 21 Member

1. What are the biggest insights from the 2022 Berkshire Hathaway Annual Shareholders Meeting?

Steven Check, Founder of Check Capital, Inc., and TIGER 21 Member, who has attended his 27th consecutive Berkshire Hathaway Annual Shareholders Meeting, said that in the first hour of the meeting, the astounding thing we heard was the fact that Berkshire bought $50 billion of stocks in the first quarter of 2022. This is the most stock Berkshire has ever bought in one quarter, and it clearly shows Warren Buffett thinks certain stocks are more attractive than cash or bonds. Berkshire now has the highest percentage of its net worth in stocks than at any time in the last 20 years!

Warren Buffett pointed out that Berkshire bought nearly 25 percent of the non-index-fund shares of Occidental Petroleum in two weeks in March. He said stock investing is largely a casino activity for most owners of stocks and this has made it easier for Berkshire to make money. Buffett said it is hard to imagine one could buy that much stock in such a short period of time, but that is Wall Street, at least for some stocks.

Marvin Blum, Founder and Managing Partner of The Blum Firm, P.C., and TIGER 21 Member, said the biggest takeaway is always my amazement at how incredibly brilliant and witty Warren Buffett (age 91) and Charlie Munger (age 98) still are. They answer questions all day, with only a one-hour lunch break, on topics ranging all over the board. They have no idea what will be asked, so there’s no way they can prepare. They are my role models. One lesson from them is to keep your brain active and never quit learning. That greatly improves the odds that we can stay sharp, even at ages 91 and 98!

My family and I have been attending these annual meetings for over ten years. It’s a great opportunity for a family bonding experience. In particular, my son Adam Blum is an avid Buffett fan and absorbs every detail. I enjoy being by his side through the whole experience, watching him take it all in, and then having great father-son discussions about it all.

The content is always educational and interesting. It is reassuring to attend at a time when the stock market is down, as Buffett and Munger are not the least bit distressed about the state of the market. They see it as an opportunity to pick up some bargains. It gives me peace of mind to just ride out the waves of the market and never panic.

Here are some of the top messages that stayed with me from the day of Q & A:

- The second half of life offers the best opportunities. Learn from mistakes you made in the first half of life, and that sets you up for success in the second half of life.

- Don’t beat yourself up over mistakes; learn from them and move forward. Warren and Charlie both made plenty of mistakes, and it never derailed them.

- In choosing a career, rule out anything you’re bad at, and then choose what you enjoy most from the rest of the options.

- Regarding investing in Bitcoin, here’s what Munger had to say: “In my life, I try and avoid things that are stupid, evil, and make me look bad in comparison to someone else. Bitcoin does all three.” Munger explained that holding bitcoin is “stupid” because he expects it to be worth zero dollars in time, “evil” because it undermines the integrity and stability of the US financial system, and makes the US “look foolish” because China’s ruling party was smart enough to ban it.

You never know when it’s our last chance to attend an annual meeting with both Buffett and Munger speaking. The meeting won’t be the same when either or both are no longer there. The interaction and bantering between these two close friends and brilliant investors is what makes the meeting magical. Anytime I hesitate about attending, I am reminded that “this year may be the last year.” I advise others to plan to attend next year’s meeting, if we’re fortunate enough for it to happen.

2. Will you do anything differently as a result of this year’s Berkshire Hathaway Annual Meeting?

Check: Attending the Berkshire Hathaway Annual Meeting always reinforces the fact that Berkshire is unique and that its culture will endure well past Warren Buffett and Charlie Munger. Warren Buffett said that he fully expects Berkshire to be doing well 100 years from now. Such longevity is rare, but Berkshire’s culture and shareholders make that more of a possibility than probably with any other existing company. One has very little to worry about Berkshire Hathaway for the next 10-20 years. The culture makes me proud to be a long-term shareholder and the annual meeting drives that home.

Blum: I am taking to heart comments Buffett and Munger made about the reasons for Berkshire Hathaway’s success and applying it to my law firm. The clear number one ingredient of their success is the company’s “culture.” Create a positive work environment where people feel they are part of a family who cares about them. Hire the best people, and then set them free to soar. My aim is to create a work atmosphere that is so appealing that those who work at my firm will be so loyal that they’ll have no interest when headhunters come along and try to lure them away. Berkshire prides itself on a work environment that no one would want to leave. As Buffett put it, “they’d have no reason to want to go work anywhere else.

3. How does TIGER 21 fit into your Berkshire Hathaway Meeting experience?

Check: A fair number of TIGER 21 Members attended the Berkshire Meeting. This year, rather spontaneously, I had dinner with four other TIGER 21 Members and a TIGER 21 Chair. We went around the dinner table and each of us stated our most interesting takeaways from the meeting. It still amazes me, that after attending for so many years, how many new nuggets come from each Berkshire Annual Meeting. They’re a national treasure, and there’s nothing else quite like it.

Blum: At TIGER 21, we celebrate lifelong learning. The Berkshire Hathaway Annual Meeting is all about bringing people together to learn. Those who attend are eager to expand their minds and gain wisdom by listening to successful role models. That’s just what we do at TIGER 21 meetings and conferences. In addition, at Berkshire and at TIGER 21, we celebrate camaraderie and the peer-to-peer experience.

The Berkshire Hathaway Annual Meeting is also a great opportunity to connect with TIGER 21 colleagues from across the country. Through TIGER 21’s Member Portal — T21 Connect, I enjoyed discovering other TIGER 21 Members in attendance, and we arranged to meet at the See’s Candies Exhibit. Even with some 30,000 people there, we had no trouble finding each other. We do this every year, and it’s always an instant connection when TIGER 21 Members meet each other. Those new relationships continue after the Omaha experience, as we enjoy reconnecting each time we see each other at conferences, Meetings, or another Berkshire Hathaway Annual Shareholders Meeting.

About TIGER 21

TIGER 21 is an exclusive global community of ultra-high-net-worth entrepreneurs, investors, and executives.

Explore the TIGER 21 Member ExperienceMember Insight Reports