Succession Planning for Blended Families

Passing an enterprise from one generation to the next involves dealing with a host of family relationship issues. To name just two: treating parents and all children (those involved in the enterprise and those not) fairly and deciding who will have an active role in future decision making. This becomes even more complicated when succession planning for blended families.

When considering possible successors, parents/owners in both blended and non-blended families assess whether (and which) children are responsible, trustworthy, motivated, competent, and prepared to manage a business or assets. While the parents in both types of families make the same assessments, the effect on the family can differ because children in non-blended families (i.e., children who share both parents) typically compete on an “even playing field.” When parents in blended families make these same determinations, however, their evaluation can separate one parent’s children from the other parent’s children. As a result, there is an additional layer of complexity, and the potential for conflict is greater than it is in non-blended families.

Maintaining relationships in the transition of a blended-family enterprise is a difficult bar to clear, so in this article, we look at this high-stakes minefield and several strategies we use to navigate it.

What is a blended family?

In general, a blended family (or stepfamily) is one with two adults and at least one child not genetically related to one of the adults. Within blended families, however, there are at least three common combinations:

- Adults married, both bringing a child (or children) from prior relationships.

- Adults married with only one adult bringing children from a prior relationship.

- Adults married with children from prior relationships who also have children together.

Within each of these categories are multiple scenarios related to children such as:

- When their parents married, the children were young and grew up together. They know each other well and have a foundation upon which to build a working relationship as teens and adults.

- When their parents married, one had grown children and one had young children, so children do not know each other well.

- When their parents married, all children were older (late teens, 20s, 30s or even older) and don’t know each other well.

And within each of these categories are scenarios related to wealth that may include some combination of:

- Wealth inherited from one parent’s ancestors. In some cases, this wealth is controlled wholly or in part by estate planning vehicles, such as trusts, set up by prior generations.

- Wealth generated by one parent prior to the current marriage.

- Wealth generated by one parent during the current marriage.

Add to these combinations the “communities of origin” or ties to ex-spouses. While divorce decrees control the financial relationship of ex-spouses, decrees do not control the quality of the interaction children have with each parent, or the values and rules of each parent’s household.

All these elements—the ages, emotional relationships among, and legal status of children, as well as the length of a marriage, source of wealth, beliefs about inheritance and emotional relationships between children and parents and stepparents—factor into enterprise succession planning in blended families.

Approaching Succession Planning for Blended Families

For blended families, creating a succession plan is comparable to skiing down a double-black diamond slope. These slopes are the steepest on the mountain. They are narrow, mogul-covered monsters that will take you down—literally, figuratively and far-from gracefully—unless you lean downhill. It’s counterintuitive, but the steeper the hill, the further forward you need to lean to make it safely to the bottom.

It’s advisable for blended families to do the same: Lean hard into the succession planning slope even though it may be quite steep and look scary. Getting to the bottom will either be an exhilarating accomplishment or a painful collection of broken family bones (i.e., relationships). Your determination to tackle and create a succession plan can greatly reduce (or possibly eliminate) the odds of a crash.

How to Create a Success Plan for A Blended-Family Enterprise

1) Identify Your Transition Goals – Your “Why”

Before taking any action, parent/business owners need to ask themselves why they want to transition an enterprise to their children. Is it because they received the enterprise as an inheritance from the last generation and want to maintain that legacy? Is it to give their children jobs or a reliable source of income? Is it to provide a solid foundation for the well-being of children, grandchildren, and generations to come?

In addition to answering these transition-related questions, we ask owners to set goals for a transition that relate to their own lives and future. After they are no longer running the enterprise, what activities will give their lives meaning? What do they want to do with their time? Where do they want to live? How do they want their family to operate? How do they want to interact with their children and with their successors, who may not be the same people?

As part of this goal-setting exercise, we ask owners to identify their deal breakers. In other words, if a transition planning option will bring about a specific event, they will not consider that option. For example, most, if not all, owners decide that they will not take any action that jeopardizes the relationship between themselves and their spouses. For other owners, a deal breaker may be risking the relationship between their blood-line children and stepchildren.

As owners begin to crystallize their thoughts about their goals and deal breakers, they can invite their spouses into their thought process. Unless spouses go into a marriage with a prenuptial agreement, these are discussions they may never have had. Initiating these sometimes-uncomfortable discussions is just one example of leaning into the slope. By understanding each other’s objectives and points of view, couples can put the odds of a successful business transition, marriage, and family in their favor.

2) Clarify What Will Be Transition – Your “What”

Every family enterprise is unique, but all contain some combination of investments. There may be operating businesses or a family office, which may include a diverse portfolio of stocks and bonds, real estate, mineral leases, private equity and/or angel investments. Few enterprises are monoliths that must be transitioned wholly intact.

Just as couples must understand each other’s transition goals, it’s valuable (whenever possible) for families to share an understanding of the elements that make up their enterprise. From this common ground they can determine how best to distribute their assets. For example, one asset could be split 50/50 between two children or one child could receive 100% of one asset and the other child 100% of another asset. It’s not unusual for parents to separate assets when children can’t (or don’t want to) work together.

3) Determine Who Your Successors Will Be – Your “Who”

The decision (or monster mogul) that keeps most owners—in both blended and non-blended family situations—from leaning into succession planning is the choice of successor. Some owners are constrained in their choice of successors by trusts set up by prior generations that restrict participation in an enterprise to blood-line descendants. While these trusts may limit which children can inherit some of a family’s assets, they don’t make treating non-blood line children fairly any easier.

There are so many factors to consider when choosing a successor that the more time families give themselves to create a succession plan, the more options they give themselves. We know from experience that the best way to increase the odds of a great outcome is for spouses to spend as much time as it takes to assess possible successors, consult with advisors, and think through possible scenarios and outcomes. Once owners pick a path and commit to it in writing, they can begin their transition journey, one that may take ten to twenty years to complete.

4) Create Your Transition Timeline – Your “When”

When parents in blended or non-blended families want to distribute assets among all their children in a way that preserves their relationships, one of the techniques we use to accomplish this goal is staged timing. Timing is especially valuable when children aren’t of similar ages. For example, a parent may retain majority control but yield operational control to an older child until a younger child is old enough to express interest (and demonstrate the ability to) in participating in operating a company or in managing assets. In addition to managing differences in ages, we can use timing to transition various levels of responsibility and control.

Looking at Succession Planning Options

Only once owners 1) establish their overall intention for the enterprise transition, 2) understand exactly what they have to transition, and 3) have a successor(s) and timetable in mind can they create a continuum of their transition options. We’ve found that laying out all possible transition options before owners establish their Why, What, Who, and When is both overwhelming and unproductive. Overwhelming because there are so many transition options and unproductive because, without understanding what owners want the transition to accomplish (and what outcomes they will not tolerate), they have no standard against which to measure an option.

Announcing Your Succession Plan

Just as there is no one way to propose marriage, there is no one way to describe a succession plan to family members. In both situations, there’s the possibility of acceptance or rejection, and in both, it’s smart to take time to plan the location and words to use. When discussing your succession plan, it’s helpful to be confident in your decision and to position your choices as gains rather than losses.

For example, if children do not know each other well, putting them in entry level and low-risk positions to give them time to try working together for the good of the family has a far better chance for tightening family bonds than saying, “Hey kids! I want you to spend more time getting to know each other!” Giving people time to develop and sharpen their skills and understand the pros and cons of working in a family enterprise increases the odds of successful outcomes for both individuals and the entire family. We also suggest that in discussions about succession, you convey an attitude of gratitude for the privilege of benefiting from an enterprise that is valuable and successful enough to pass to the next generation.

The Succession Planning Slope

Succession planning for blended-family enterprises is complicated, can be bumpy, and there’s the potential for huge gain and terrible loss. Like a double-black diamond slope, navigating it safely takes preparation (i.e., planning), the right equipment (i.e., advisors), technique (i.e., leaning into the tough issues) and guts. And yet, there’s no straighter line to success than pointing your skis over the edge, leaning forward, and then enjoying the ride.

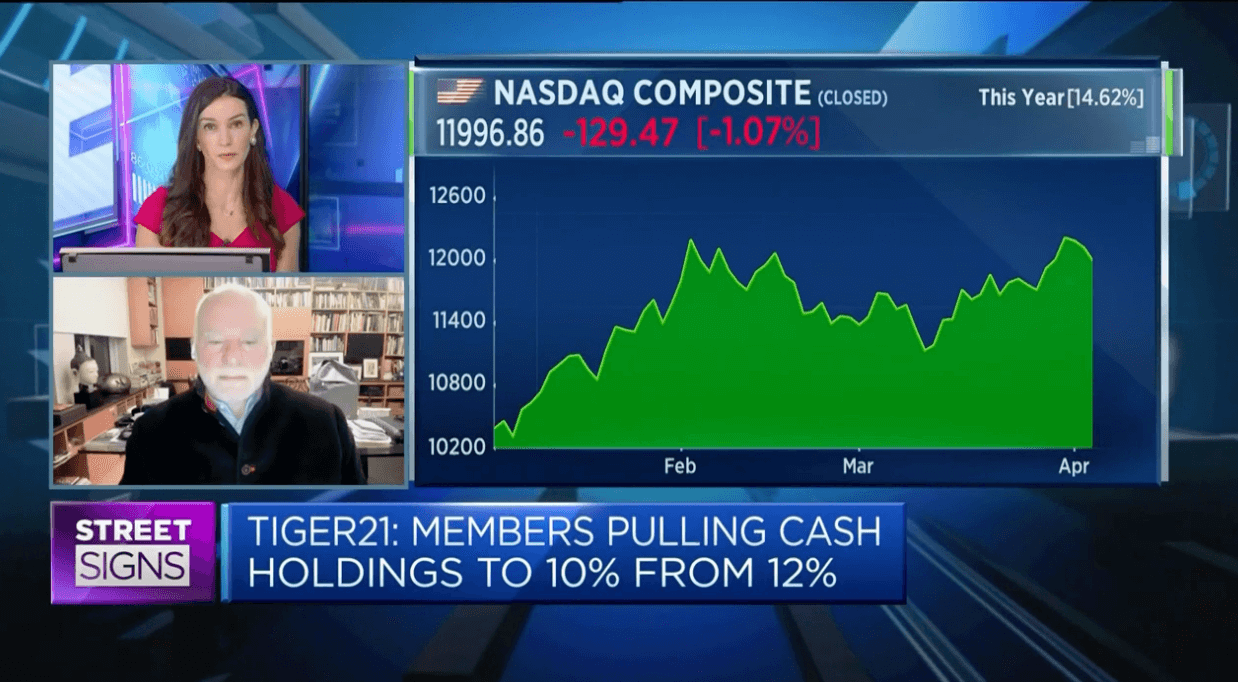

Succession planning is one of the many topics that TIGER 21 Members discuss within their monthly Group Meetings. For additional information on succession planning, read our blog, What is Succession Planning.

About Elizabeth Ledoux

Elizabeth Ledoux is the founder of The Transition Strategists and serves as a Denver Chair for TIGER 21, the premier peer membership organization for high-net-worth entrepreneurs, investors, and executives. She is a thought leader and speaker on the topics of succession planning, navigating transitions for companies and leaders, family business, strategic growth, and the business journey. Elizabeth is the host of the podcast, The Business Transition Roadmap, and author of three books for business owners and entrepreneurs including her latest, It’s A Journey – The MUST-HAVE Roadmap to Successful Succession Planning.

Nothing contained in this article shall constitute, or should be construed as, constituting investment advice or a recommendation by any of the author, “Elizabeth Ledoux,” her company, “The Transition Strategists,” or TIGER 21.

About TIGER 21

TIGER 21 is an exclusive global community of ultra-high-net-worth entrepreneurs, investors, and executives.

Explore the TIGER 21 Member ExperienceMember Insight Reports