Impact Investing

What Is Impact Investing?

Impact investing combines the pursuit of financial returns with the goal of achieving positive social or environmental outcomes. By also emphasizing measurable contributions to societal and ecological well-being, impact investing differs from traditional investing, which focuses primarily on maximizing profit.

Impact investing prioritizes positive social or environmental outcomes, in addition to financial returns.

This article explores the importance of impact investing, including the types you might encounter, examples of successful impact investments, data on the kind of financial returns investors can expect, and a look at the current state of the landscape.

The Importance of Impact Investing

Impact investing offers several high-level benefits, particularly for ultra-high-net-worth individuals. By integrating social and environmental considerations into their investment decisions, UHNWIs can:

Enhance Portfolio Diversification

Impact investments often involve emerging markets and innovative sectors, providing opportunities for diversification beyond traditional asset classes.

Align Investments with Personal Values

Impact investing offers the opportunity for UHNWIs to support causes that matter to them—including areas such as sustainability, climate change, healthcare access, mental health, education, and literacy—ensuring their investments reflect their values.

Drive Social and Environmental Change

By directing capital towards initiatives that address local and/or global challenges, investors can contribute to meaningful societal and environmental improvements.

Mitigate Risk

A recent study suggests that companies with strong environmental, social, and governance (ESG) practices may exhibit greater resilience, which could contribute to a lower risk profile.

Companies with strong environmental, social, and governance (ESG) practices may exhibit greater resilience.

What Are the Types of Impact Investments?

Impact investments can take many forms, catering to a wide range of investor interests and goals. The main types of impact investments include:

Socially Responsible Investing (SRI)

Socially responsible investing (SRI) involves selecting investments based on ethical criteria. Investors might, for example, decide to exclude companies that engage in practices they find objectionable, such as tobacco production or weapons manufacturing. These investors may instead choose to support businesses that align with their ethics or moral values.

Environmental, Social, Governance (ESG) Investing

ESG investing focuses on companies that exhibit strong environmental, social, and governance practices. Companies that prioritize ESG principles offer investors a way to prioritize considerations like sustainability, positive social impact, and transparency in leadership.

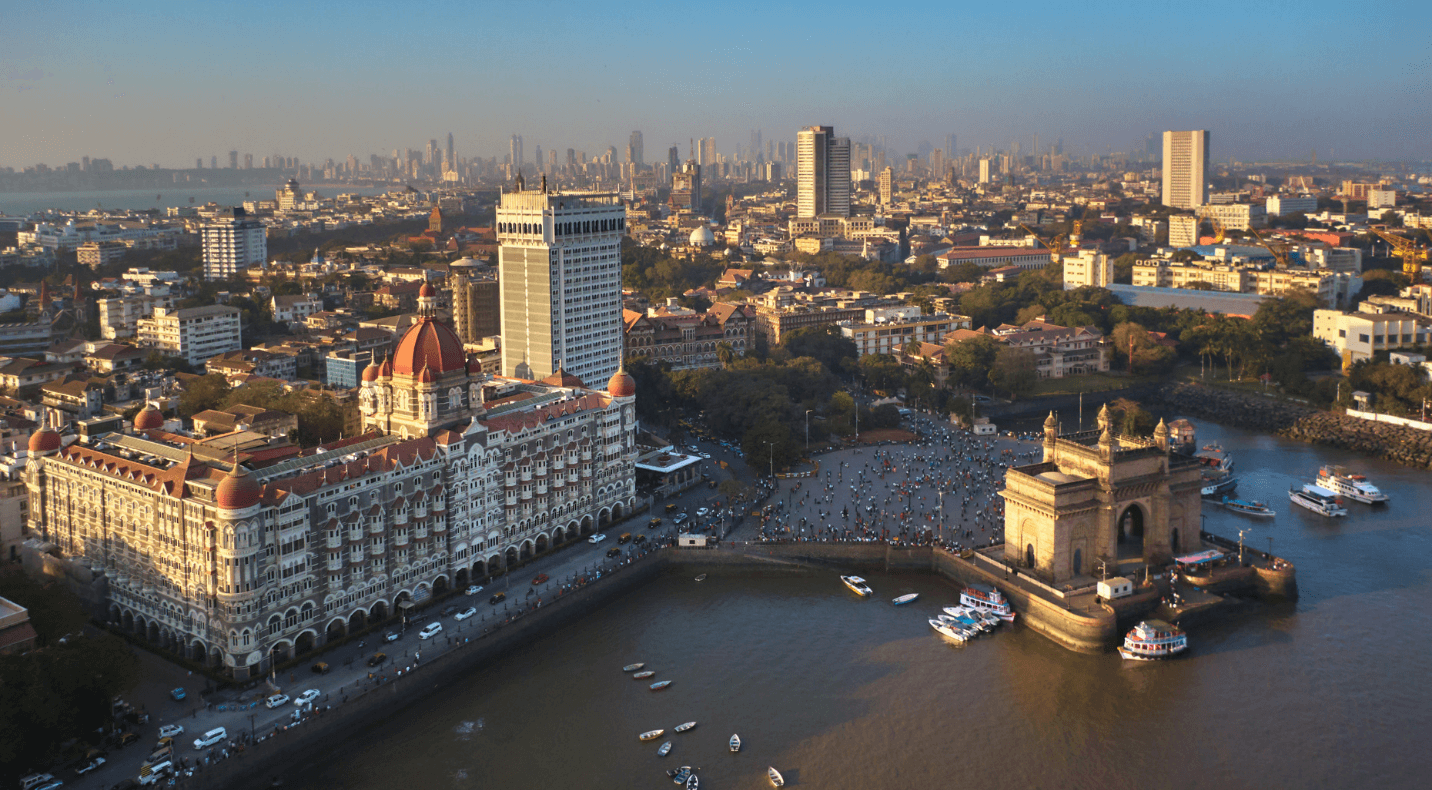

Emerging Markets

Investing in emerging markets involves supporting developing regions in sectors that include healthcare, education, energy, and agriculture. These investments can lead to significant improvements in quality of life and encourage healthy economic growth.

Investments in emerging markets can lead to significant improvements in quality of life and encourage healthy economic growth.

Impact investments can also span various industries, as long as the investments 1) promise financial returns, while 2) aligning with positive social and/or environmental outcomes. For example, impact investors’ portfolios may include holdings in:

Healthcare

Funding healthcare initiatives can improve access to medical services and technologies, reducing mortality rates, improving quality of life, and enhancing overall well-being.

Information Technology

Investments in information technology can drive innovation in areas like education, healthcare, and sustainability, promoting social and environmental progress.

Community Investing Programs

Community investing focuses on financing projects that benefit local communities, enhancing economic growth and social equity.

Energy

Investing in sustainable and renewable energy projects can address the impact of climate change, while providing clean energy solutions to underserved communities.

Examples of Impact Investments

As impact investing continues to mature and develop, more global examples of successful impact investments are emerging, including:

Microfinance Institutions

Organizations like Grameen Bank provide small loans to entrepreneurs in developing countries, empowering them to start businesses and improve their economic conditions.

IKEA

IKEA champions sustainability through renewable energy, ethical sourcing, and circular economy practices. Its investments in sustainable materials and carbon reduction reflect a strong alignment with impact investing principles.

Impact Funds

Rather than choosing a single company or institution, impact investors can also choose to invest in an impact fund. Some impact funds allow investors to zero in on specific outcomes that matter to them, such as “green” real estate, renewable energy, or microenterprise in developing nations.

How Do Impact Investments Typically Perform?

Impact investments can offer competitive financial returns while achieving social and environmental goals. A study from the Global Impact Investing Network (GIIN) reported that the majority of respondents’ impact investments performed in line with their expectations, both from a financial (79%) and an impact (88%) perspective.

| 79% | Percentage of respondents whose impact investments performed in line with their financial expectations |

Factors that may influence the performance of impact investing may include:

Market Demand

Growing consumer and regulatory demand for sustainable products and services could drive future success of impact investments.

Company Resilience

As noted earlier, companies with strong ESG practices may demonstrate greater resilience in times of economic uncertainty, potentially reducing investment risk.

Long-Term Value

By focusing on long-term sustainability goals, impact investments may be more likely to generate enduring value.

Current State of the Impact Investment Landscape

The impact investment landscape is rapidly evolving, with increasing interest from both institutional and individual investors. In fact, the global impact investing market size is estimated to grow from 3 trillion USD to 7.78 trillion USD over the next 10 years.

| 7.78 Trillion | Estimated size of the global impact investing market by 2033 |

In recent years, more investors are recognizing that impact investing offers not only the potential for positive societal and environmental change but also competitive financial returns. As a result, the market is expanding with a diverse array of investment opportunities, ranging from small-scale projects to large institutional funds.

Look for the following key trends to continue to shape the current landscape:

Enhanced Reporting Standards

Improved social and environmental impact metrics and reporting standards will continue to enable investors to better measure and compare the impact of their investments.

Mainstream Adoption

Large financial institutions and asset managers are increasingly incorporating impact investments into their portfolios, signaling growing interest in impact investment strategies.

Government Support

Although barriers remain in navigating governmental regulations, only 13% of private-market investors in a GIIN report found that it “significantly affected” their strategy, possibly signaling an increasingly favorable environment for impact investing.

Impact Investing: Building Wealth While Advancing Societal and Environmental Progress

Impact investing presents a compelling opportunity for ultra-high-net-worth individuals to align their financial goals with their values, drive social and environmental change, and achieve competitive returns. As the impact investment landscape continues to mature, advances in impact measurement frameworks will deliver improved management and results, further quantifying and amplifying the societal and environmental effects of impact investing.

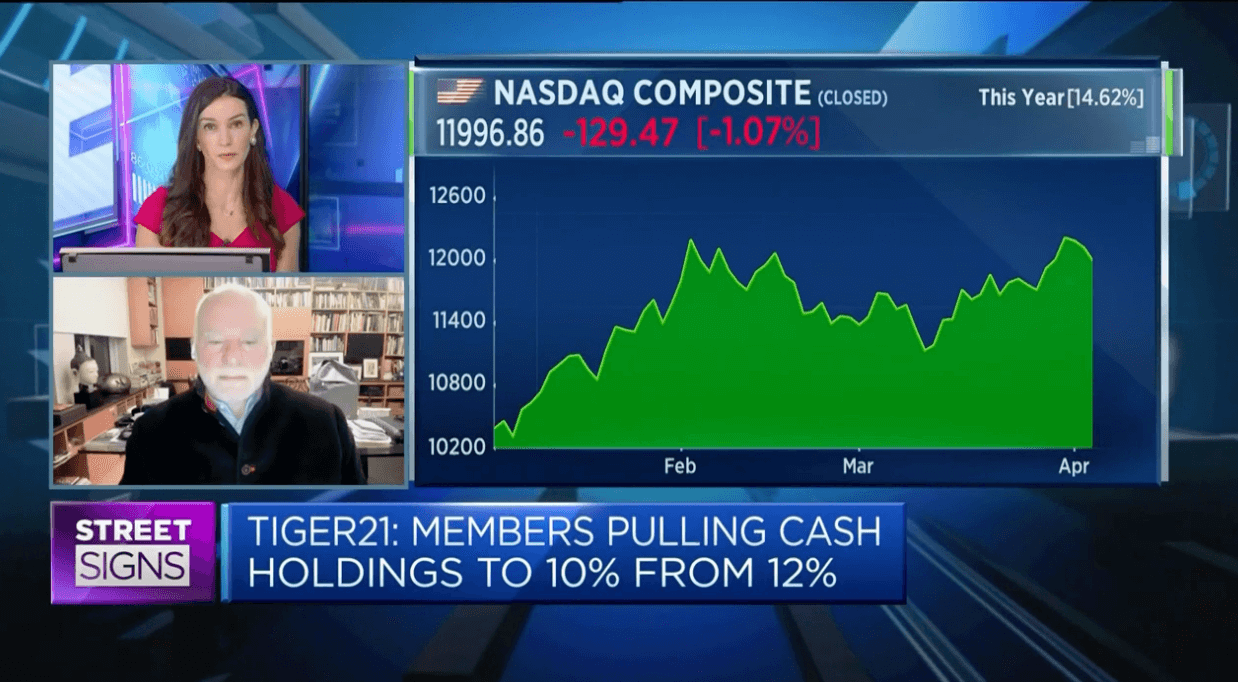

If you’re interested in further exploring impact investing—and other financial opportunities—with a set of like-minded peers, we invite you to learn more about the TIGER 21 global network.

TIGER 21 provides Members with a personal board of directors for candid discussions around topics that include wealth creation and preservation, family, legacy, and philanthropy. Members also enjoy access to private learning sessions, one of which recently focused on using private credit strategies and vehicles for impact investments.

About TIGER 21

TIGER 21 is an exclusive global community of ultra-high-net-worth entrepreneurs, investors, and executives.

Explore the TIGER 21 Member ExperienceTags

Member Insight Reports