INVESTING IN THE CRYPTO ASSET CLASS

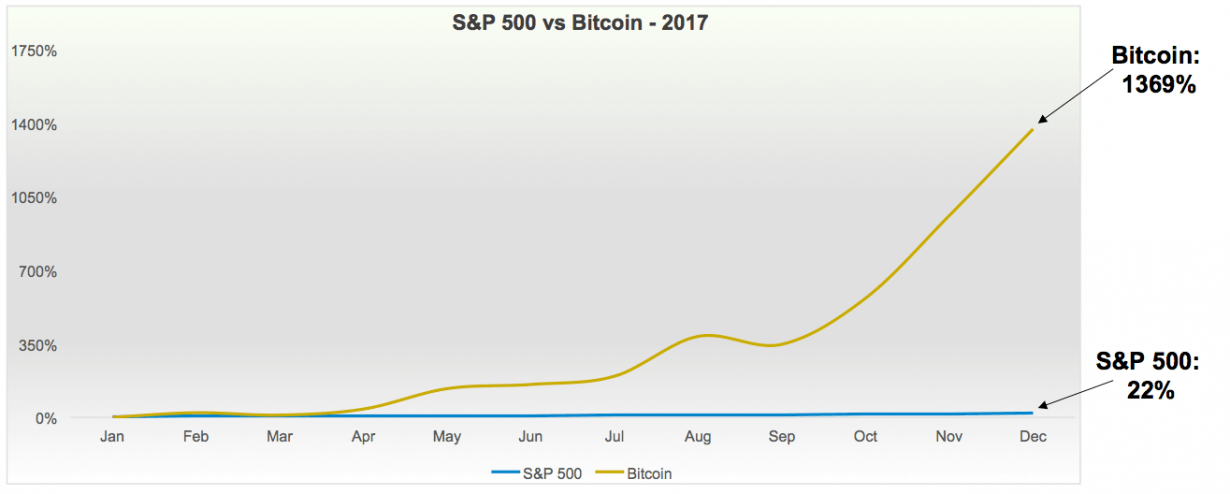

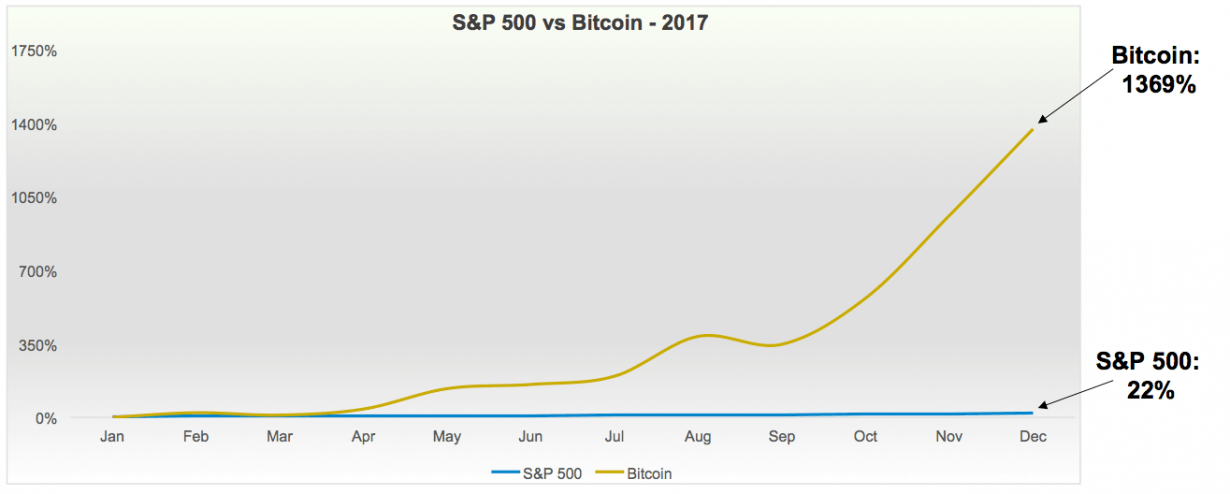

Investing in cryptocurrency (“crypto”) can be a confusing affair. With over 1,600 crypto assets in existence, many investors have been lured into the space by tales of minimal investments resulting in epic returns, only to realize it’s not as simple as they first thought. Despite the inherent volatility and complexity of investing in this nascent asset class, blockchain sits atop many lists of the most disruptive technologies, alongside artificial intelligence, big data and more. For those who want exposure to all disruptive technologies, it may be considered a must-have. Bitcoin, the highest-valued of the 1600 crypto assets, increased in value 1369% in 2017 and 135% in 2016. Ethereum, the second-highest-valued, increased 9383% in 2017 and 754% in 2016 (not shown). Both are down about 50% in 2018. Note that the above comparison is between a single asset (Bitcoin) and an index of assets (S&P 500).

Bitcoin, the highest-valued of the 1600 crypto assets, increased in value 1369% in 2017 and 135% in 2016. Ethereum, the second-highest-valued, increased 9383% in 2017 and 754% in 2016 (not shown). Both are down about 50% in 2018. Note that the above comparison is between a single asset (Bitcoin) and an index of assets (S&P 500).

There are multiple strategies to invest in crypto assets, but this article will highlight the following ways: – Passive investing, with one or many assets – Active management, with one or many strategies.

- We do not cover in this article investing in blockchain equity. Blockchain company investments are typically equity, with the normal angel/venture capital horizon of 7 years. Crypto investors have poured into assets like Bitcoin for an investment that mimics venture capital economics, but provides instant liquidity. In addition, many investors feel more confident that crypto assets like Bitcoin, unlike angel or VC, won’t go to zero. $5B of Bitcoin trades per day, on over 10,000 exchanges (source: coinmarketcap.com), so the myth of a lack of liquidity may exist for large institutions, but not for most individuals.

Passive Investing

- Buy and Hold

By far the simplest approach to crypto asset investment is the “buy and hold” method. Bitcoin is often the target currency for this approach, and it can be as unrefined as buying a fraction of a Bitcoin on Coinbase via credit card and leaving it there for the long term. For those wanting solid exposure with minimal complexity, this is a good place to start.

Pro Tip: Rather than purchasing all at once, use dollar cost averaging to spread your purchase out over a predetermined period of time.

- An Index

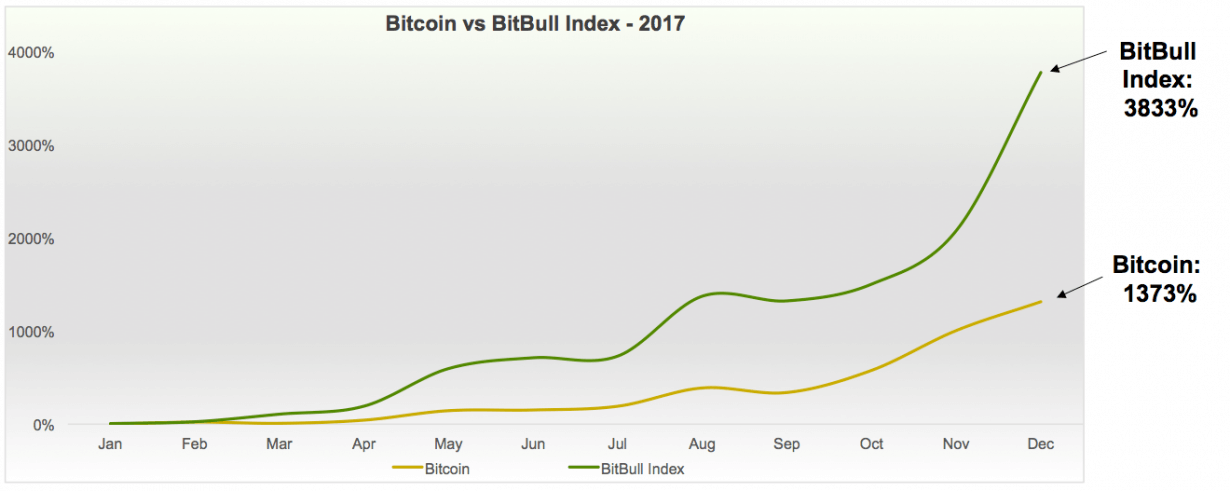

Tying the fate of your investment to a single asset is rarely a smart move. While Bitcoin purists may object, it’s easy enough to verify that an index of top crypto assets has historically outperformed Bitcoin. Indexes typically have more beta than Bitcoin, so in a bull market they’ll fare better, and in a bear market they’ll fare worse.

Pro Tip: If you do not want to deal with creating your own custody solution, there are a handful of proven crypto index funds that take the guesswork out of selecting, securing and rebalancing your crypto holdings – for a fee.

Active Investing

- Crypto Hedge Funds

Crossing the divide from passive to active management brings us to the ever-expanding world of crypto hedge funds. There are over 300 crypto hedge funds today, with strategies ranging from pre-ICO investment (a very directional strategy) to arbitrage (a market-neutral strategy).

The simplicity of an index is appealing during a year like 2017, when the asset class experienced exponential positive growth; however, the volatility of 2018 has proven the value of an actively managed approach to crypto asset investment. During the first half of 2018, a top-30 index returned around -63%, while crypto hedge funds attempt to limit downside with a variety of strategies.

Pro Tip: Carefully read the Private Placement Memorandums of Crypto Hedge Funds.

- A Fund of Funds

The last strategy that we will explore is a fund of funds, or diversified active management. By spreading your investment out among multiple managers who are implementing a variety of strategies, you gain unparalleled exposure to this emerging asset. Just as the 1600 crypto assets are startups, so are the 300 crypto hedge funds. There can be an immense benefit in this volatile asset class to active management, but there can also be an immense benefit to due diligence on the active managers and monthly rebalancing of these managers and strategies. Pro Tip: An attractive fund of funds will offer access to funds that are closed to others, or that would otherwise have high minimums.

“BitBull Index” represents the average historic performance of select cryptocurrency hedge funds. Past performance does not guarantee future results. Next Steps

The strategies touched on above all land at varying places on the risk-reward continuum. It is important that any investor interested in gaining crypto exposure do thorough due diligence on any strategy they may be considering. Your individual risk appetite will determine the most suitable strategy for your portfolio.

While the preferred amount of exposure must be decided on a case-by-case basis, many investors are beginning to enjoy both the education and diversification of holding crypto assets.

About the Author

Joe DiPasquale is CEO of BitBull Capital and frequently presents to TIGER 21 Groups. He has been acryptocurrency investor since 2013.

About TIGER 21

TIGER 21 is an exclusive global community of ultra-high-net-worth entrepreneurs, investors, and executives.

Explore the TIGER 21 Member ExperienceMember Insight Reports