How to Take the Emotion Out of Art Acquisition

Being that the purpose of art is to evoke emotion, it is hard not to let emotions play a big part in its acquisition. Successfully acquiring art requires you to put that emotion aside and make an assessment of the true value of the piece based on an objective set of criteria, especially if you are looking to procure art at least in part for its future investment value.

When you find a painting or another piece of art that interests you and you begin to consider purchasing it, conducting due diligence is a critical step. The piece should be passed through a series of important “quality control” criteria. Then, if you or a trusted expert determines that the quality is excellent, you can begin reviewing the market analytics around the investment opportunity and begin negotiations.

It is important to consider key quality criteria as the foundation of high-quality artwork, regardless of price:

Artist: Obtaining information about the artist will go a long way in determining the piece’s value. You should ask: How successfully does the artist sell at auction? How many times has the artist sold at auction? If the artist does not sell at auction, which galleries represent the artist? Is the artist represented in museum holdings? Has the artist participated in important exhibitions?

Medium: Generally, original works such as oil on canvas, watercolor, or ink-on-paper have a better chance of continuing to go up in value. Prints can be an excellent acquisition, but be careful of edition size and quality.

Size: A small work will never achieve growth in value beyond a certain point, and works between 16 inches and 40 inches are the most logical size. However, some contemporary artists may always work in larger sizes.

Subject Matter: When you think of Andy Warhol, you may think of a Campbell’s Soup Can. That is because this is the subject matter, which is the essence of the Pop Art movement. The price for one of his works depicting a Soup Can will always surpass the price of a portrait of an unrecognizable figure.

Rarity: A work that is fresh to the market and has never been seen will generally be more expensive. A rare edition bronze or a low edition print will generally be more expensive than a high edition print.

Provenance: A painting previously exhibited in important shows and recorded as owned by notable collectors will have a higher price. In addition, provenance helps to establish the authenticity of the painting.

Sales History: This is a huge red flag. Many dealers will acquire paintings when they go unsold because they can buy them at a better price. It is essential that you confirm the sales price at auction. Understanding the market for the artist is the beginning of your negotiation.

When you have the answers for each of these questions and all of the above criteria, you will have enough information to negotiate. In the art world, knowledge is power, and the information you gather will help you determine the most accurate price and whether the work is a good asset acquisition. While this may seem like an overwhelming amount of information needed to acquire a work, you will find that it will be worth it. At Pall Mall Art Advisors these criteria are applied to every acquisition and to every value. As a result, we likely can save a client upwards of 20 percent on a work of art.

There are other factors to consider once you have acquired the work that will have an impact on your bottom line and cost basis. Where the work is stored and strategy for “use” can have a major impact on sales and use tax. For example, if the artwork is stored in Oregon or Delaware, which are states that do not have a sales tax, this can be waived. In addition, creating a “use” strategy for the artwork can also save you from paying a use tax. Californians need to be particularly careful of the use tax.

Remember, don’t purchase a piece based on emotion.Be sure to conduct your due diligence before you acquire any works of art.

Anita Heriot is President of Pall Mall Art Advisors, a global appraisal and advisory firm focused on meeting the challenges of a continuously changing market in the collection of fine art and other valuables.

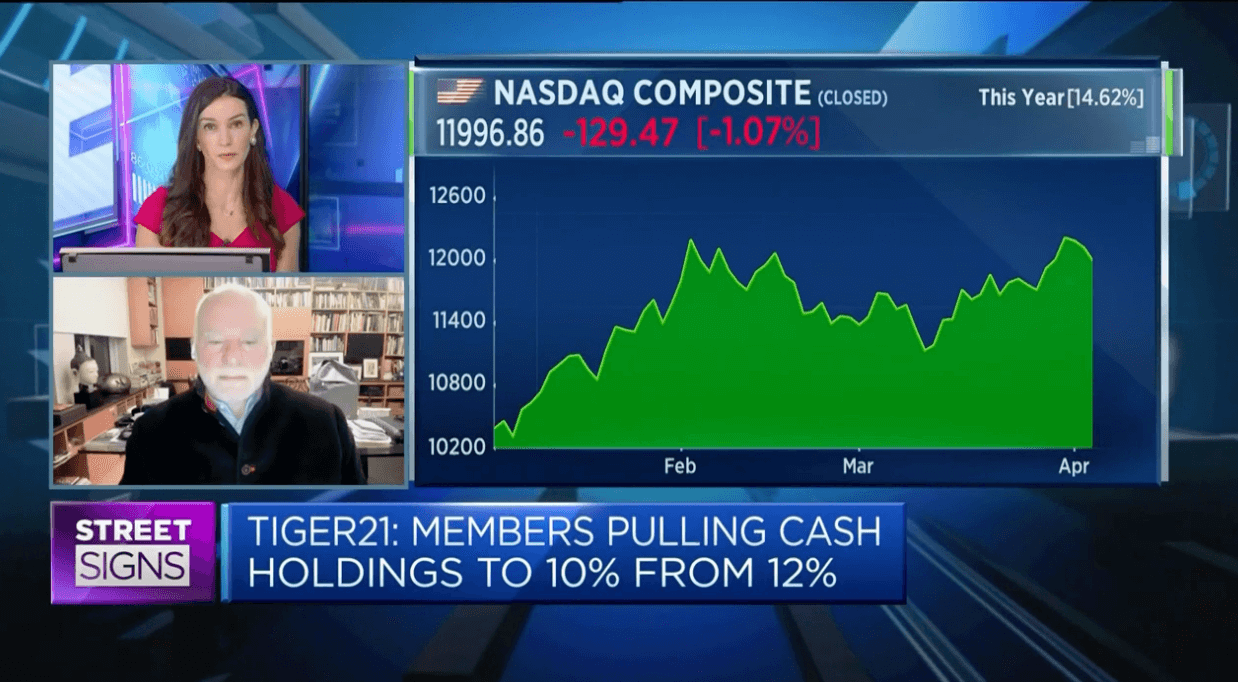

About TIGER 21

TIGER 21 is an exclusive global community of ultra-high-net-worth entrepreneurs, investors, and executives.

Explore the TIGER 21 Member ExperienceMember Insight Reports