Blockchain Beyond Crypto: Evaluating NFTs, the Metaverse, and Play-to-Earn Games

Blockchain Beyond Crypto: Evaluating NFTs, the Metaverse, and Play-to-Earn Games

The blockchain was originally conceptualized in 1991, the same year that the Dow Jones exceeded 3,000 for the first time. However, it wasn’t until 2009 that blockchain got its first real-world implementation, when the mysterious developer Satoshi Nakamoto implemented the first blockchain to launch the cryptocurrency Bitcoin.[1]

In addition to powering Bitcoin, blockchain technology is being deployed in increasingly creative ways that leverage the public nature of each transaction. One example, the Aura Blockchain Consortium—created by LVMH, Prada Group, and Cartier—allows buyers to authenticate luxury goods from raw materials all the way through the point of sale and beyond. Another—a partnership between the Norwegian Seafood Association and IBM—offers a track-and-trace system to prove the provenance of Norwegian seafood. The seafood industry has long been plagued by problems of mislabeled fish and outright fraud, and the IBM Blockchain Transparent Supply Platform aims to change all that.[2]

As blockchain innovations continue to offer companies unique solutions to specialized challenges, what kind of opportunities does it hold for investors?

Opportunities and Insights for Investing in the Blockchain Space

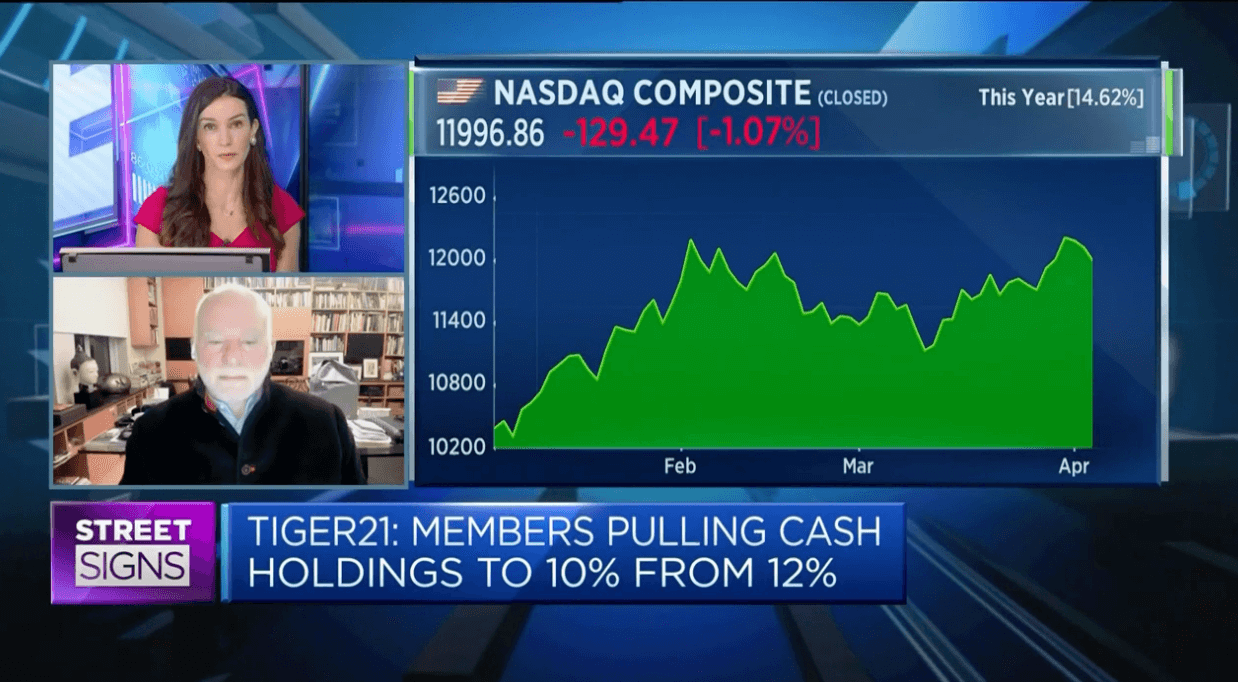

TIGER 21 spoke with three Members heavily invested in the cryptocurrency/blockchain space for a roundtable discussion moderated by Nashville Chair, Jeff Hays. We asked them:

“Where, outside of cryptocurrency, are you seeing opportunities for investors within the blockchain space?”

TIGER 21 Member Andy Sack, Founding Partner at KeenCrypto LLC, shared the following insight:

“I’m spending a lot of time in the NFT space. I think the metaverse is super exciting, particularly as Apple, Facebook, and some of the other large players innovate and introduce new eyewear for virtual reality.

“The entry point for crypto and blockchain is going to be gaming. I actually think that crypto and blockchain are a bit esoteric. Gaming is not esoteric. Ask anyone who has a 13- to 18-year-old.

“I believe that play-to-earn is the next wave of gaming. People are going to be entering into the crypto space by playing a game, and they’re not even going to know that they’re in the crypto space.

“Those areas, the metaverse and gaming, as they intersect with NFTs, present, in my opinion, the most exciting opportunity for venture-style returns for the next five years.”

For additional investment perspectives from our TIGER 21 Cryptocurrency Roundtable, see our Insights article, “Investing in Cryptocurrency: TIGER 21 Member Perspectives.”

[Read More]

With Member Andy Sack’s comments in mind, we’ll walk through each of the three areas mentioned above—NFTs, the metaverse, and play-to-earn gaming—and discuss some of the available opportunities for investors.

We’ll start by taking a deeper look at NFTs.

The Future of NFTs: Boom or Bust?

The first NFT, Quantum, was minted on May 2, 2014, by artist Kevin McCoy.[3] However, it wasn’t until projects such as CryptoKitties—in which you could buy, breed, and sell digital cat NFTs, all powered by the Ethereum platform—that NFTs began to gain significant traction.[4]

What is an NFT? Non-fungible tokens are digital assets representing real-world objects like digital NFT art, music, and videos that are bought and sold online using cryptocurrency. A big part of their appeal lies in the limited nature of each NFT, which comes with a unique identifying code.

Not familiar with NFTs? Our TIGER 21 Insights article, Crypto Collectibles 101 | Non-Fungible Tokens,

offers a good primer.

CryptoKitties launched in 2017, and a look at the market cap of global NFT transactions from 2018 to 2020 illustrates the subsequent explosive growth in the market:

Market Capitalization of Global Transactions Involving an NFT

| 2018 | 2019 | 2020 |

|---|---|---|

| $41 million | $142 million | $338 million[5] |

Numbers stayed strong into 2021, with nearly $40.9[13] spent on NFTs in 2021, according to the Financial Times. As one measure of comparison, UBS and Art Basel pegged the global art market value at $50.1 billion. Within the market, CryptoPunks NFTs led the way with more than $3 billion in transaction volume between March and October of 2021.[6]

NFTs vs. Traditional Art

| $40.9 billion Total spent on NFTs in 2021 | $50.1 billion Value of the 2021 global art market[7] |

However, starting in February 2022, the NFT market started to slide. The total market capitalization for NFTs, once $23 billion, dropped to $11.2 billion by May 2022, according to CoinMarketCap.[8]

In one particularly illustrative incident, an NFT of Jack Dorsey’s first Tweet, which originally sold for over $2.9 million in March 2021, received a paltry bid of $280 during an April 2022 auction. Although the owner, CEO Sina Estavi of the blockchain company Bridge Oracle, claimed that he received a private offer of $10 million, he decided to retain ownership of the NFT.[9]

Even still, investors continue to purchase NFTs. In late May 2022, $24.3 million in sales were generated in a 24-hour period during the release of the Trippin’ Ape Tribe, a new NFT series from Solana.[10]

Some continue to argue that the NFT market is all speculative, that there’s no “there” there.

However, others point to the potential for NFTs tied to real-world opportunities. Take, for example, the Bored Ape Yacht Club collection of NFTs, which counts Steph Curry and Mark Cuban as owners. The club held its first in-person, members-only meetup in 2021, dubbed ApeFest. Admission to events and other real-world perks, some argue, give these NFTs some tangible, real-world value.

Additionally, NFTs also occupy a key spot in the two other blockchain applications we’ll discuss next—the metaverse and play-to-earn games.

Investment Opportunity: Fractionalization

In June 2021, an NFT of Kabosu, the Shiba Inu featured in the original “doge” meme (and the mascot for the cryptocurrency Dogecoin) sold for $4 million. In September 2021, the owners of the NFT fractionalized it into 17 billion tokens ($DOG). They subsequently sold 20% of those tokens in a 24-hour auction, pushing the total valuation for the NFT to $225 million.[11]

Fractionalization will be a trend to watch, both for investors looking to get pieces of larger, more popular NFTs and for those who may want to fractionalize their own NFTs.

Additionally, some NFT experts believe the market will consolidate behind the most well-known brands and images. As a result, fractional opportunities in these areas may be more likely to hold their value over the long term.

Defining and Investing in the Metaverse

I think the metaverse is super exciting, particularly as Apple, Facebook, and some of the other large players innovate and introduce new eyewear for virtual reality.

TIGER 21 Member Andy Sack, Founding Partner at KeenCrypto LLC

Although the concept of the metaverse has been around since at least 1992, Facebook’s rebranding to “Meta” in October 2021 raised the metaverse’s profile significantly. Writer Neal Stephenson originally coined the concept in his novel, Snow Crash. Stephenson’s Metaverse is a virtual world that people tap into with virtual reality goggles.

However, as the metaverse moves beyond science fiction into today’s reality, what, exactly, is the metaverse? In its simplest terms, Lyron Bentovim, CEO of virtual and augmented reality company, The Glimpse Group, calls it “the 3D Internet.”[12] In other words, the metaverse is the Internet taken to the next step, a fully-realized virtual world where, in its loftiest incarnations, no single entity is in control.

Ultimately, the metaverse is still an ideal. Although several virtual worlds have been created, there’s no single place where all of them intersect. Additionally, there’s no clear-cut winner with significant widespread adoption.

For example, consider the following projects, which continue to flirt with the actualization of the metaverse:

- Second Life, created by Linden Labs in 2003, offers users the opportunity to create their own avatars and navigate a landscape of virtual experiences, communities, and relationships. As of 2020, its creators claimed 900,000 active monthly users. However, external estimates put numbers in the range of 40,000 concurrent users daily.[13]

- Epic Games says it’s creating a metaverse through its “connected social experiences.”[14] Fortnite, its most well-known product, offers players the opportunity to collaborate on virtual missions, battle for survival in a Hunger Games-style competition, and create their own virtual worlds.

- Roblox is a game platform with a twist. Instead of offering pre-made games designed by the platform’s owners, Roblox is a place where people go to play games made by other users—and to make games themselves. In recent months, Roblox has made some significant moves toward realizing a true metaverse. By upgrading its avatars, Roblox gave users the opportunity to build a more sophisticated online identity—a sticking point for many platforms. Additionally, the platform partnered with Paris Hilton to launch Paris World, the celebrity’s own virtual island for hosting virtual parties and experiences.

- Decentraland, as the name implies, is a platform that prioritizes the idea that the metaverse will not be owned by any single entity. Instead, it should belong to its users and grant them ownership of the world they’re building. Sotheby’s recently bought into the concept, hosting a show in its virtual gallery that hosted 3,200 visitors.[15]

None of these worlds connect—yet. If they did, users could move freely between worlds, bringing tools and resources from one to the other. This scenario, experts argue, will approach something closer to representing the true realization of the metaverse.

Investment Opportunity: Supporting the Development of the Metaverse

Investors who are interested in backing the future of the metaverse have a number of options to consider, including:

- Metaverse-focused venture capital funds like Hiro Capital, BITKRAFT Ventures, and Metaverse Ventures.

- The first exchange-traded fund designed to track the performance of the metaverse, the Roundhill Ball Metaverse ETF (META) launched in June 2021. It was quickly followed by a number of competitors, all aimed at offering investors a piece of the emerging opportunities in the metaverse.

- Stock is also available for public companies working in the metaverse arena, such as Roblox (RBLX). Alternatively, investors might also consider stock in companies whose technology will support the future of the metaverse, such as Nvidia (NVDA). Their NVIDIA Omniverse is currently being marketed as a platform for connecting 3D worlds into a shared virtual universe.[16]

- Coins used in the metaverse frontrunners—such as the MANA coin, which powers Decentraland—are available on exchanges like Coinbase. Alternatively, investors who strongly believe in the future of a specific platform, like Decentraland, might also consider purchasing digital real estate, as Sotheby’s has done.

Finally, we’ll move from one of the most esoteric applications of blockchain platforms to one of its most concrete and alluring ones: gaming.

Gaming: The Play-to-Earn Space

I believe that play-to-earn is the next wave of gaming. People are going to be entering into the crypto space by playing a game, and they’re not even going to know that they’re in the crypto space.

TIGER 21 Member Andy Sack, Founding Partner at KeenCrypto LLC

Play-to-earn (P2E) gaming brings together the online gaming world, blockchain technology, NFTs, and cryptocurrency—all in one consumer-friendly package.

What are play-to-earn games? Simply put, they’re games that reward users with assets for investing their time on the platform. For play-to-earn games on blockchain platforms (also known as GameFi), these assets may be cryptocurrency. They may also be NFTs, which may be useful within the game or simply aesthetically desirable.

P2E gamers with their eyes on profits need to invest their time wisely. Some games offer rewards that are easy to convert to real-world value, such as ether or bitcoin. Others, like NFTs or game-specific tokens, may not have much value outside each platform.

Finally, some play-to-earn games are free, while others require some kind of buy-in to get started. For example, to access the game ICE Poker in Decentral Games, you have to purchase an ICE NFT Wearable.

Play-to-earn remains a developing space, so new entries pop up often. Two examples currently getting a lot of attention include:

- Axie Infinity – If you’re familiar with the concept of Pokémon, Axie Infinity falls along similar lines. To get started, you have to purchase three Axie NFTs—stylized, animated creatures based on the axolotl salamander. Battle your team against others to earn in-game tokens, which include the Axie Infinity Shard token (AXS) and Smooth Love Potion (SLP). It’s worth noting that Axie Infinity hasn’t been immune to cryptocurrency’s overall slide. After reaching a market cap of $8,463,172,444 in November 2021, Axie Infinity’s market cap slipped to just $1,121,994,065 by late May 2022.[17]

- The Sandbox – Partnerships with big names like Atari, the Walking Dead franchise, and musical artists Deadmau5 and Snoop Dogg have helped make the Sandbox a highly anticipated platform, one that could easily belong in the earlier discussion about the metaverse. After a long lead-up, the Sandbox is currently launching in stages. Each Alpha Season offers users a limited window to explore experiences and quests while earning NFTs and SAND, the Sandbox utility token. Digital real estate in the Sandbox universe, called LAND, is also available for purchase.[18] Once the Sandbox is in full swing, players will be able to develop their own games and virtual worlds. As a community-driven platform, the Sandbox will allow SAND holders to participate in major decisions via a Decentralized Autonomous Organization (DAO), anticipated to launch in mid-2022.[19]

As TIGER 21 Member Andy Sack noted above, these consumer-friendly applications have the potential to take cryptocurrency and blockchain technology mainstream. In fact, The Verge reported that some Axie Infinity players in the Philippines are already paying their rent with the SLP token.[20]

As more users access play-to-earn games—and cryptocurrency becomes a simple commodity that fuels online entertainment—all of these blockchain concepts may go more mainstream.

Investment Opportunities in the Play-to-Earn Space:

Investors who want to snag a piece of the play-to-earn space have a few options.

For those who are deeply interested in the games themselves and want to stay on top of this fast-moving space, options include:

- Purchasing the tokens that power the games, such as SAND (The Sandbox) or AXS/SLP (Axie Infinity), on an exchange such as Coinbase. Investors profit when the price of those tokens rises.

- Buying assets within the worlds that host these games, such as digital real estate (LAND in the Sandbox) or in-game NFTs, with the belief that these assets will rise in value.

Investors who see potential in the play-to-earn space but don’t necessarily find themselves interested in following game development as closely may also consider investing in the blockchain technology that powers these games, such as Ethereum and Solana.

The Future of Blockchain Technology

In December 2011, you could buy a bitcoin for less than $5, and the word “blockchain” was an obscure idea, known to relatively few. Today, blockchain-based platforms and metaverse-centric companies are operating with valuations in the billions.

The bottom line? The blockchain space is expanding rapidly—and exploding with innovation. With new applications, experiences, and possibilities popping up around the blockchain platforms powering this innovation, opportunities for interested investors abound.

Nothing contained in this article shall constitute, or should be construed as, constituting investment advice or a recommendation by TIGER 21, its Chairs or Members.

[1] https://hbr.org/2017/02/a-brief-history-of-blockchain; https://www.icaew.com/technical/technology/blockchain-and-cryptoassets/blockchain-articles/what-is-blockchain/history

[2] https://www.lvmh.com/news-documents/news/lvmh-partners-with-other-major-luxury-companies-on-aura-the-first-global-luxury-blockchain/

[3] https://hyperallergic.com/652671/kevin-mccoy-quantum-first-nft-created-sells-at-sothebys-for-over-one-million/

[4] https://www.nasdaq.com/articles/nfts-were-born-on-ethereum.-now-its-time-to-help-them-grow-up-2021-10-13

[5] https://www.statista.com/statistics/1221742/nft-market-capitalization-worldwide/

[6] Chainalysis 2021 NFT Market Report: https://go.chainalysis.com/nft-market-report.html; https://www.ft.com/content/e95f5ac2-0476-41f4-abd4-8a99faa7737d

[7] https://www.ft.com/content/e95f5ac2-0476-41f4-abd4-8a99faa7737d

[8] https://coinmarketcap.com/nft/, accessed 5/27/2022

[9] https://www.bbc.com/news/business-61102759; https://www.coindesk.com/business/2022/04/13/jack-dorseys-first-tweet-nft-went-on-sale-for-48m-it-ended-with-a-top-bid-of-just-280/

[10] https://decrypt.co/101342/solana-overtakes-ethereum-daily-nft-trading-trippin-ape-tribe

[11] https://www.coindesk.com/markets/2021/09/02/record-doge-nft-sale-highlights-growing-demand-for-fractionalization/

[12] https://www.fool.com/investing/2021/11/01/why-the-metaverse-is-probably-a-bigger-deal-than-y/

[13] https://www.vice.com/en/article/4aydzg/virtual-reality-is-going-to-change-live-events-culture-forever; https://nwn.blogs.com/nwn/2021/10/second-life-median-user-concurrency.html

[14] https://www.epicgames.com/site/en-US/news/announcing-a-1-billion-funding-round-to-support-epics-long-term-vision-for-the-metaverse

[15] https://www.nytimes.com/2021/07/10/style/metaverse-virtual-worlds.html

[16] https://blogs.nvidia.com/blog/2021/08/10/what-is-the-metaverse/

[17] https://www.fool.com/the-ascent/cryptocurrency/articles/what-is-axie-infinity-axs-and-should-you-buy-it/; https://coinmarketcap.com/currencies/axie-infinity/historical-data/, accessed May 30, 2022.

[18] https://sandboxgame.gitbook.io/the-sandbox/land/what-is-land

[19] https://installers.sandbox.game/The_Sandbox_Whitepaper_2020.pdf

[20] https://www.theverge.com/2021/10/13/22725083/axie-infinity-sky-mavis-blockchain-economy-game-pokemon

About TIGER 21

TIGER 21 is an exclusive global community of ultra-high-net-worth entrepreneurs, investors, and executives.

Explore the TIGER 21 Member ExperienceMember Insight Reports