Sustainable Investing | TIGER 21 Founder Talks Planting a Legacy

Sustainability initiatives and corporate accountability metrics have kept a searing spotlight on the global climate crisis and the search for solutions to save our planet. As a result, sustainable investing has been discussed with more frequency among investors.

Sustainable Investment Solutions

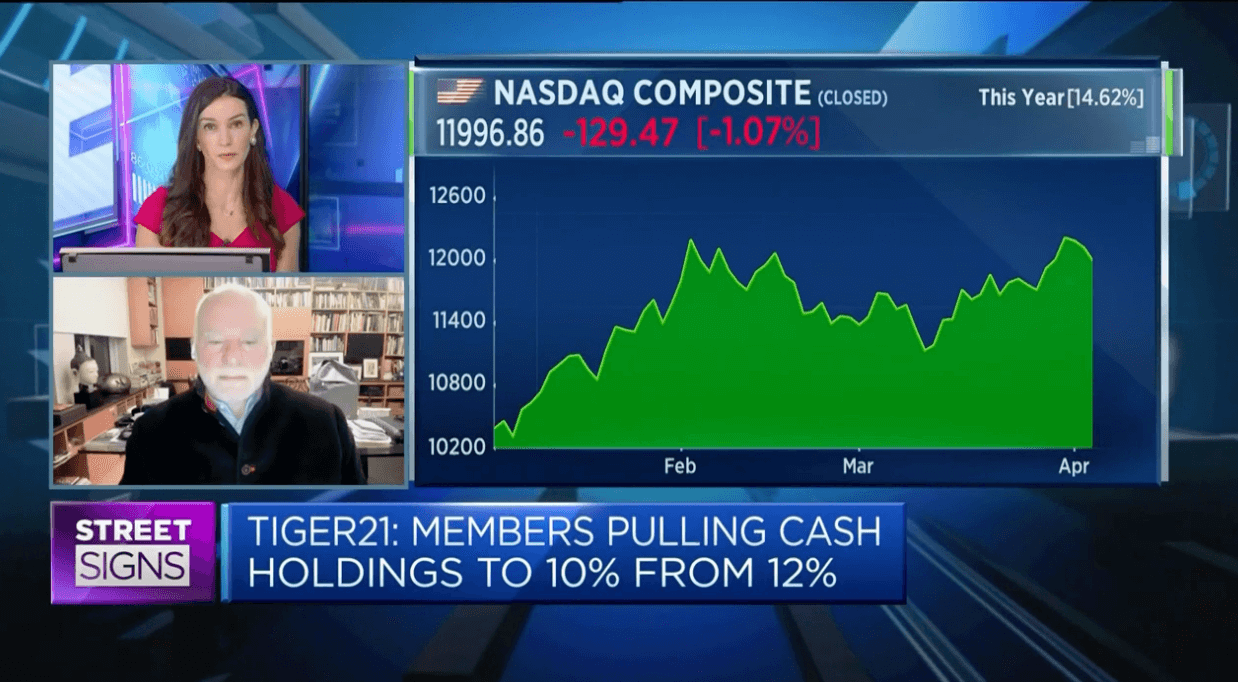

While the problem may seem ominous, one sustainability thought leader believes the solutions already exist, they just need to be implemented in a new way. Michael Sonnenfeldt is a serial entrepreneur, investor, philanthropist, and founder of TIGER 21, the premier peer membership organization for high-net-worth entrepreneurs, investors, and executives. He sat down with Trish Costello, founder of Portfolia, the leading women’s investment firm for a conversation on sustainable investment and solutions from land use to legacies.

Sonnenfeldt first started investing in environmental opportunities over 30 years ago when he decided to back a startup in the solar lighting space, devising new ways to harness solar power for roadway and parking lot lighting applications. Three decades later, he dedicates his efforts to solving sustainability challenges from food supplies to energy and environmental issues.

He believes we already have answers. During the discussion with Portfolia, Sonnenfeldt shared his vision for a greener, healthier world.

The acid rain example. When considering the current climate crisis, Sonnenfeldt points to America’s acid rain pollution problems of the 1970s and 1980s as a model for action. “When you have government and market involvement, things can change quickly. The first time markets were used to make an environmental impact was about 30 years ago when we needed to address acid rain. There was a particular problem between the Canadian and American border. Secretary Shultz, a great diplomat, championed a pricing mechanism for acid rain. And when you harness the force of the market, it creates not only reductions, but it unleashes entrepreneurial activity. And acid rain was cured in a fraction of the time it was estimated, and at a fraction of the cost.”

New carbon consumption models. Sonnenfeldt sees the same opportunity for change with carbon consumption. “Right now, it’s wonderful to be debating how best to address climate, but the ability to have a carbon tax or carbon pricing mechanisms would mobilize markets far faster. I suspect we’ll hear about the carbon tax very soon, because in the end, it will unleash far more entrepreneurial activity, and distribute assets more efficiently to save the planet.”

What is Sustainable Investing? According to The Forum for Sustainable and Responsible Investment, sustainable investing is an investment discipline that considers environmental, social, and corporate governance (ESG) criteria to generate long-term competitive financial returns and positive societal impact. Sustainable investment is often focused on two approaches, the first being ESG incorporation which is the consideration of ESG criteria in investment analysis and portfolio construction across a range of asset classes. The second strategy is filing shareholder resolutions and practicing other forms of shareholder engagement. This strategy is aimed at investors who have shares in publicly traded companies, Sustainable investment strategies are aimed at encouraging responsible business practices and allocating capital for social and environmental benefit across the economy.

Sonnenfeldt’s Focus. Sonnenfeldt feels it is important to distinguish between sustainable investing (which he is generally very supportive of) and investing to decarbonize the atmosphere (which is a subset of the “sustainable” world and focused on fighting change).

New uses for thermal energy. Sonnenfeldt predicts new applications for thermal energy. “You will see the harnessing of geothermal power, the most plentiful and cheapest source around. People put up houses and burn fossil fuels when the ground could heat and cool the house, essentially for free, but for the electricity that moves the water around. Some people still don’t see it, they can’t make the connections. But for those who understand it, thermal energy will become an all-out preoccupation and focus. We’re going to have to rethink our own uses of energy.”

Batteries are the future. “The key to renewable power will be reliable, dispatchable power. Not just when the wind blows, or when the sun shines. So if you were looking for a single investment, think batteries. Batteries are the ability to time shift from when energy is produced, and when it’s used. There will be a whole new generation of power producers that can reliably deliver energy as needed – which could be 24/7, or in any other “shape” the customer needs it. Without the certainty of reliable power which can be delivered exactly when needed, utilities won’t be able to retire coal fired “base-load” power plants, or the gas powered “peaker” plants. But before they can do that, they need reliability. And that’s just the exciting moment that we’re in right now.”

Five percent could change everything. “Researchers estimate that we could address climate change at a price of about 5% of GDP. Who wouldn’t give up 5% of their income, if you could solve a problem, that if we don’t solve it, will imperil our children’s or grandchildren’s future, and the future of all humanity? And the time is now to do it. Fortunately, we know what to do. We have the resources to do it. The question is, do we have the will? And that’s really up to each of us.”

About Portfolia

Portfolia designs investment funds for women to invest in the innovative companies they want to see in the world for returns and impact. Portfolia invests in entrepreneurial companies, activating the wealth of accredited individuals from all over the country (particularly women) at an approachable minimum investment within high-growth segments that are routinely undervalued or poorly understood by traditional venture capital. The average investment in a fund is $25,000 providing an ownership position in 8-12 early-stage companies (Seed to Series C).

Lorine Pendleton, Esq., Lead Investment Partner for Portfolia’s Rising America Fund, also serves as New York City TIGER 21 Chair and Angela Jackson, Co-Founder and GP of Portland Seed Fund, is Portland TIGER 21 Chair and Lead Investment Partner for Portfolia’s FIRSTSTEP Fund.

About TIGER 21

TIGER 21 is an exclusive global community of ultra-high-net-worth entrepreneurs, investors, and executives.

Explore the TIGER 21 Member ExperienceMember Insight Reports