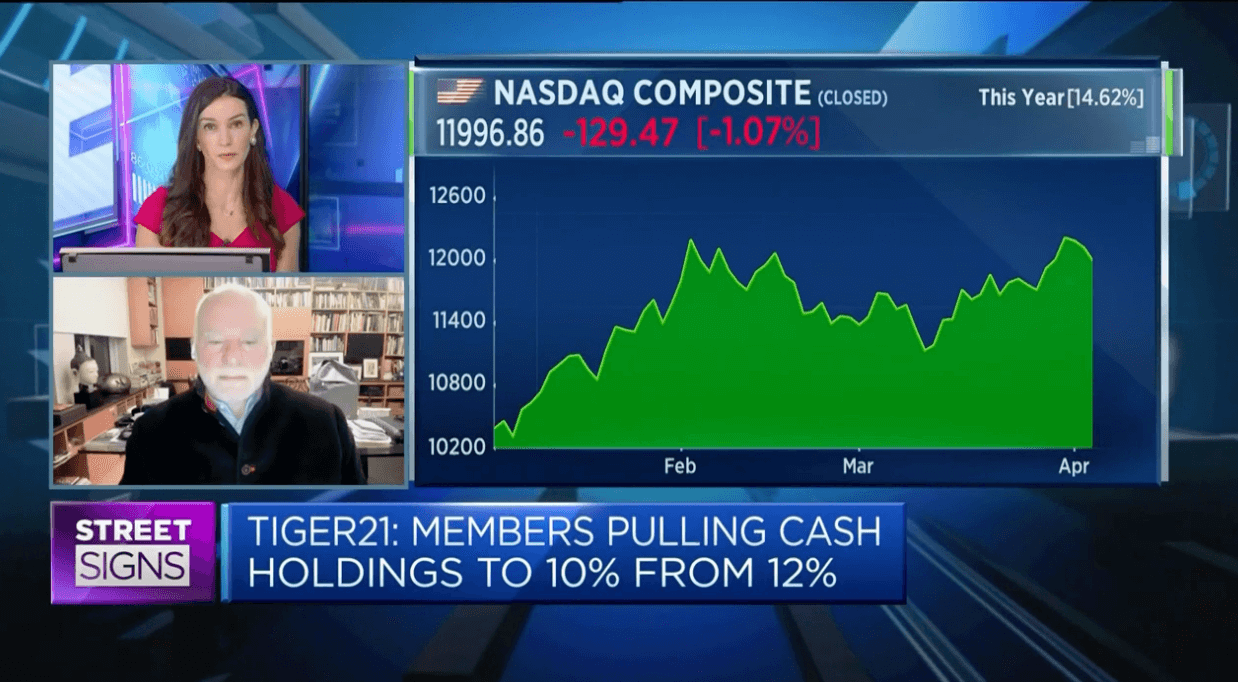

The Five Biggest Risks to Cryptocurrency Investments: Insights from High-Net-Worth Investors

When the value of bitcoin exceeded $66,000 for the first time in October 2021, news headlines were flush with optimism for the future of cryptocurrency.

“Bitcoin Surges to All-Time High in Crypto’s ‘Validating Moment'” (Bloomberg[1])

“Bitcoin Tops $66,000, Sets Record as Crypto Goes Mainstream” (AP[2])

However, after reaching an all-time high of more than $69,000 in November 2021, the cryptocurrency traded its steady rise for a return to volatility. By January 2022, the price of bitcoin had slipped to $37,928.58. After a spike in March 2022, back up to $47,063.37, bitcoin went into another long slide that took its value below $20,000 in June 2022.

| $69,044 November 2021 | $37,929 January 2022 | $47,063 March 2022 | $19,047 June 2022 |

Whether these ups and downs leave you bullish or bearish on the future of Bitcoin and other cryptocurrencies, risk analysis is a key element to evaluating any investment. As a follow-up to our recent article, Investing in Cryptocurrency: TIGER 21 Member Perspectives, we’ll take a look at the flip side of cryptocurrency investing: the risks. By examining the potential risks looming on cryptocurrency’s horizon, we’ll offer additional perspectives on the investment’s potential future.

To gather insights in this arena, we talked to three TIGER 21 Members who are deeply invested in the cryptocurrency and blockchain space. We asked them:

What are the biggest risks associated with the future of cryptocurrency?

They shared their thoughts in a roundtable discussion, facilitated by Nashville TIGER 21 Chair, Jeff Hays. You’ll find their outlooks on cryptocurrency risks below.

In the roundtable discussion between these three investors, we asked them to share their viewpoints on the biggest threats to cryptocurrency. The following five risks emerged during the discussion.

Cryptocurrency Risk #1: A Total Loss of Value

Although bitcoin’s slide left some bearish on cryptocurrency, you’ll still find many investors eager to articulate the bullish side of the argument—even during significant downturns. In our most recent Member poll on the topic, held in June 2022, the TIGER 21 community has remained solidly divided on the topic since first asked in May 2021:

TIGER 21 Member Poll:

Are you bullish, bearish, or neutral on the cryptocurrency market?

June 2022: 16% – Bullish 44% – Bearish 40% – Neutral

May 2021: 27% – Bullish 28% – Bearish 45% – Neutral

To explore this issue, one of TIGER 21’s London Groups hosted its own “Cryptocurrency vs. Gold” debate for Members with leading presenters. One Canadian entrepreneur and gold investor argued for gold in an interactive discussion.

He explained his passion for gold investing, “Gold is, to me, the only real answer that has stood the test of time. Fads come and go. Bubbles come and go. Gold just sits there quietly in its eternal glory. To me, if I want to sleep at night, I’ll put my money in gold.”

He also acknowledged that many are looking to Bitcoin as an alternative to fiat currencies. “There are a lot of very smart people making a very strong case for Bitcoin for that reason,” he noted.

However, he continued, Bitcoin won’t rise to the level of gold until it gets universal adoption. At that point, Bitcoin might finally become “a store of value, where you can go to sleep at night and not worry that you’re going to wake up in the morning and you’re going to be down 80%. It could happen, but [until then] you’re speculating.”

Is there a possibility that Bitcoin goes bust? Although he anticipated scenarios in which the currency would take a significant nosedive, Andy Sack, TIGER 21 Member and Managing Partner at KeenCrypto LLC, doesn’t believe that zero is a possibility.

As he put it during our roundtable:

“Do I see a scenario in which it loses 80% of its value, like it has historically? Sure, I could see that. And I would expect there to be a lot of tension over the next few years between regulation and innovation. When I add it up, there is a scenario in which 80% of the value is lost.”

“Does it go to zero? No. Even with that, I think it comes back. I don’t think it can be stopped. The genie can’t be put back in the bottle, I don’t believe.”

Beyond the question of volatility, however, many have greener concerns around cryptocurrency.

Cryptocurrency Risk #2: Environmental Concerns

Mined cryptocurrency—including Bitcoin, Litecoin, and Ethereum (for now)—requires massive amounts of computing power. This translates into several environmental consequences, including:

Electricity Usage

Exactly how much electricity does global cryptocurrency mining really take? Estimates have been as high as 121.36 terawatt hours per year, according to a University of Cambridge analysis—more than the usage of the entire country of Argentina.[4] After China declared all cryptocurrency transactions illegal, one estimate of global cryptocurrency mining power usage dropped to 70 terawatt hours per year, which is still nearly equivalent to the annual usage of the country of Chile.[5]

Resource Usage & Ecosystem Impact

Because of the massive amount of heat cryptocurrency mining generates, it creates some unexpected environmental consequences. Greenidge Generation, a former coal power plant in Dresden, NY that now acts as a cryptocurrency mining operation, offers one example. The operation uses fresh water from nearby Seneca Lake to cool the plant. The plant discharges water that’s 30-50° F hotter in temperature, which local residents argue threatens the delicate balance of the area’s local ecosystem. The New York Department of Environmental Conservation is currently reviewing the operation’s water and air permits.[6]

Noise Pollution As cryptocurrency mining operations continue to proliferate, a new side effect has emerged: noise pollution. A resident in a community adjacent to a large Bitcoin mining operation in Tennessee is suing the operator. The plaintiff has argued that the noise from Red Dog’s mining facility “unreasonably interferes” with the “use and enjoyment” of the resident’s property.[7] This is just one example of this phenomenon, which has also caused grief for citizens in Norway and Canada.[8]

Will these—and other—environmental concerns pose big problems for cryptocurrency going forward?

Sherry Witter, TIGER 21 Member and Managing Partner, Co-Founder & CIO at the Witter Family Office, says no—at least in terms of energy usage.

“What we’ve been seeing since China has kicked out the Bitcoin miners is that people have scattered. A lot of them have come to Texas. The electricity traders I talk to are not seeing a huge jump in the electricity consumption because of the policies in the United States around clean energy.”

“A lot of the miners are using clean energy to mine. If anything, we feel like they’re getting better for the environment, because they’re using technology to mine more cleanly. China couldn’t really provide all the resources for clean energy. In America, miners have access to all these different programs, which include benefits and tax breaks. Anyone who’s come to America to start mining is doing it in an environmentally responsible way.”

“That could change as mining increases. But that’s what the current data suggests today.”

David Bailey, TIGER 21 Member and Founder/CEO of BTC Incand Bitcoin 2022 Conference, took a slightly different tack on the energy issue. As he put it:

“I’m going to take a little ‘out there’ perspective on it. I actually think that Bitcoin’s biggest strength is the amount of energy that it consumes.”

“I actually think it’s going to consume a lot more energy going into the future because it’s directly tied to the price of Bitcoin. If the price of Bitcoin grows by 100X it becomes 100X more profitable to be a Bitcoin miner. More people are going to want to mine, and that’s going to create a huge amount of investment into energy production and energy technology.”

“So, I actually see Bitcoin as a massive industrial boon to the world that, in my opinion, is going to usher in a new industrial age. We’re going to see huge sums of new types of power and types of energy sources. That’s going to be massively beneficial to all of society.”

As for the newer environmental side-effects—including issues like resource usage and noise pollution—it remains to be seen how local residents and municipalities will deal with these issues as cryptocurrency continues to mature.

Beyond environmental concerns, some worry that the anonymity of cryptocurrency lends itself to darker purposes—questionable, fraudulent, or just plain criminal activity.

Cryptocurrency Risk #3: Ties to Illegal Activity

Bitcoin’s reputation as an anonymous form of payment led many to believe it would become a magnet for criminal activities. The fact that bitcoin accounts for approximately 98% of ransomware payments[9] hasn’t improved Bitcoin’s image—or that of cryptocurrency in general.

However, when you take a broader perspective, two things become clear:

The percentage of cryptocurrency used in criminal activities is very small—only 2.1% of the total cryptocurrency sent and received in 2019, according to a report from Chainalysis, a blockchain data platform company. They estimate that number at just 0.34% for 2020.[10]

Additionally, when you look at the global GDP associated with criminal activity, it becomes clear that cryptocurrency is only a small fraction of the total. The UN estimates that anywhere from $1.6–4.0 trillion is associated with criminal activity. However, Chainalysis’s report estimates that cryptocurrency only accounted for $21.4 billion in criminal activity in 2019 and $10.0 billion in 2020.

| Global GDP Associated with Criminal Activity, (UN Estimate)[11] $1.6–$4.0 trillion | Cryptocurrency Value Sent and Received by Criminal Entities: 2019 $21.4 billion | Cryptocurrency Value Sent and Received by Criminal Entities: 2020 $10.0 billion |

In other words, illegal activity via fiat currency is still much more prevalent than that conducted via cryptocurrency. Additionally, as a report from strategic advisory firm Beacon Global notes, illicit activity is “overwhelmingly conducted through traditional financial intermediaries.”[12]

Finally, cryptocurrency isn’t as anonymous as many would like to believe. Because transactions are recorded in the blockchain, certain identifying details of crypto transactions are publicly available. Additionally, U.S. courts have ruled that investors have no reasonable expectation of privacy when it comes to blockchain transactions.

As a result, law enforcement agencies have been working with firms like Chainalysis to use the blockchain to track down illicit actors. The company’s current clients include the Federal Bureau of Investigation (FBI), the Drug Enforcement Agency (DEA), Immigration and Customs Enforcement (ICE), the Internal Revenue Service (IRS), and the U.S. Secret Service, among other domestic and international agencies.[13]

David Bailey offers his take on the question of illegal activity associated with cryptocurrency:

“My response would be, ‘Illegal to whom?’ Every country has its own set of laws and policies, and they conflict with each other all the time. I think that there’s no better endorsement of Bitcoin’s value proposition than Bitcoin being banned by the Chinese government. [Bitcoin] is subversive because it keeps the government from controlling certain elements of what its citizenry can do—their ability to move money out of the country, for example. I think that that’s in the eye of the beholder, whether those laws are moral or not.”

“Bitcoin is math. Math does not care about policy. It doesn’t care about political laws. That’s its strength.”

Bailey’s comment about policy created a springboard for the next risk to cryptocurrency: regulation.

Cryptocurrency Risk #4: Regulation and Taxation

Called the “number-one risk to crypto” by Andy Sack, many investors are keeping a wary eye on how government regulation might affect the crypto space. As one indicator, China’s crackdown on crypto had a significant effect on the price of bitcoin, which dropped 5%, and Ethereum, which dropped 7%.[14]

In March 2022, the Biden administration took an initial step toward U.S. crypto regulation with an Executive Order on Ensuring Responsible Development of Digital Assets. The order laid out a series of objectives, including consumer protection, financial stability, preventing illicit activity, reinforcing U.S. leadership, safe financial innovation, and responsible technological development. It also called for an exploration into a U.S. Central Bank Digital Currency (CBDC).

Sack says to expect more regulation in the arena:

“I do think that most people expect the recent regulatory move from China as a lead-in to some sort of state-sponsored digital currency out of China. Hands down, across the world, sovereign nations view the right to print money and control money supply as an essential right, one that needs to be defended.

“Cryptocurrency runs right up against that, so I would expect regulation is definitely the number-one risk.”

Despite the potential risks to cryptocurrency investments, Sack went on to say that, as an investor, he welcomes regulation. “As a society, we’ve not been particularly thoughtful about the way in which these new technologies affect our democracy and culture. I think government and regulation is a necessary and welcome role.”

Sherry Witter agreed with Sack. “Regulation will be a good thing for countries in our society.” However, she went on to say,

“The fear I have for the United States is taxation. There are rumors and rumblings in Washington. What if they tax [the crypto community] at 90% for transactions?”

However, Witter was confident that investors would still find a way to move forward, despite heavy tax burdens. “If they decide to tax us, we’ll simply hold our crypto, trade around it and get leverage against it. This would briefly slow us down, but we’re going to come right back up.”

Finally, the roundtable discussion continued with a consideration of how cryptocurrency might create new geopolitical dynamics.

Cryptocurrency Risk #5: Geopolitics

The risks and consequences of unregulated digital currencies are already on the mind of many world leaders.

In October 2021, the Group of Seven nations issued a statement that they’re working on common principles to govern Central Bank Digital Currencies. Their intent? To ensure that CBDCs uphold “commitments to transparency, the rule of law and sound economic governance.”[15]

David Bailey believes items like this are just the beginning:

“Countries are grappling with the geopolitical dynamic that is starting to come into play. I think governments are going to crack down.”

As Sherry Witter put it, “Crypto is about taking control away from the government. So they have to move to CBDCs.”

Additionally, Bailey noted that cryptocurrency has the potential to upend one of the most prominent geopolitical dynamics of the last eighty years: the dominance of the U.S. dollar. As he put it, “I don’t think we’re intellectually ready for what the world looks like when there is no U.S. dollar hegemony. That’s where I think the biggest risks come in.”

However, not all countries are looking to crack down on cryptocurrency. Ukrainian President Volodymyr Zelenskyy legalized cryptocurrency in March 2022, amidst its invasion by Russia. By the end of March, cryptocurrency donations to the country’s official government entities totaled more than $60 million. Ukraine-focused NGOs, including the popular UkraineDAO, logged an estimated $50 million in crypto-donations. A study from TRM labs reported that Bitcoin and Ethereum made up the vast majority of the donations.[16]

Ultimately, cryptocurrency is emerging as a force in both the global financial and geopolitical arenas. Global leaders will need to decide how to reckon with it—with potential risks and consequences for investors.

Evaluating the Risks of Cryptocurrency and Capitalizing on Opportunity

As Sherry Witter noted, cryptocurrency investments have delivered unmatched returns to investors in the last few years. These gains have attracted even more investors to the space, pushing coin values even higher.

However, as the volatility of late 2021 and the first half of 2022 has demonstrated, every investment comes with risks. And when it comes to innovative concepts like cryptocurrency and blockchain, the risks can be equally new, varied, and complex. In other words, even as investors eye the myriad opportunities that crypto and blockchain create almost daily, they also need to keep tabs on the burgeoning risks that can emerge just as quickly.

[1] https://www.yahoo.com/now/Bitcoin-climbs-record-high-futures-134540561.html

[2] https://apnews.com/article/technology-business-Bitcoin-exchange-traded-funds-6ddf8f3dfe0cd927ae988f5ddefe5fec

[3] Chart sources: https://www.forbes.com/sites/jonathanponciano/2021/11/10/bitcoin-hits-new-record-high-after-inflation-surges-to-30-year-peak; https://www.statista.com/statistics/326707/bitcoin-price-index/

[4] https://www.bbc.com/news/technology-56012952

[5] https://www.cnbc.com/2021/07/20/bitcoin-mining-environmental-impact-new-study.html; accessed 11/19/2021

[6] https://news.climate.columbia.edu/2021/09/20/Bitcoins-impacts-on-climate-and-the-environment/; https://gothamist.com/news/bitcoin-mining-operation-finger-lakes-runs-against-new-yorks-climate-law; https://www.fingerlakesdailynews.com/2022/03/31/1387826/

[7] https://news.Bitcoin.com/Bitcoin-mining-operation-being-sued-for-producing-high-noise-levels-in-tennessee/

[8] https://Bitcoinmagazine.com/business/noise-complaints-may-cause-norwegian-Bitcoin-mining-center-shut-down; https://www.wsj.com/articles/Bitcoin-mining-noise-drives-neighbors-nuts-giant-dentist-drill-that-wont-stop-11636730904

[9] https://www.marsh.com/us/services/cyber-risk/insights/ransomware-paying-cyber-extortion-demands-in-cryptocurrency.html

[10] https://blog.chainalysis.com/reports/2021-crypto-crime-report-intro-ransomware-scams-darknet-markets

[11] https://www.forbes.com/sites/haileylennon/2021/01/19/the-false-narrative-of-Bitcoins-role-in-illicit-activity/?sh=3ace6b873432

[12] https://www.cryptoforinnovation.org/resources/Analysis_of_Bitcoin_in_Illicit_Finance.pdf

[13] https://blog.chainalysis.com/reports/law-enforcement-agencies-cryptocurrency/; https://www.coindesk.com/business/2020/02/10/inside-chainalysis-multimillion-dollar-relationship-with-the-us-government/; https://law.justia.com/cases/federal/appellate-courts/ca5/19-50492/19-50492-2020-06-30.html; https://www.wired.com/story/tracers-in-the-dark-welcome-to-video-crypto-anonymity-myth/

[14] https://www.cnbc.com/2021/09/24/Bitcoin-ethereum-sink-as-china-intensifies-crypto-crackdown.html

[15] https://www.gov.uk/government/publications/g7-finance-ministers-meeting-june-2021-communique/g7-finance-ministers-and-central-bank-governors-communique

[16] https://www.coindesk.com/policy/2022/03/16/ukraines-zelensky-signs-virtual-assets-bill-into-law-legalizing-crypto/; https://www.trmlabs.com/post/update-on-ukrainian-crypto-donations

About TIGER 21

TIGER 21 is an exclusive global community of ultra-high-net-worth entrepreneurs, investors, and executives.

Explore the TIGER 21 Member ExperienceMember Insight Reports